Insight Focus

- The container shipping industry has endured a tough 2023 after solid performance in the prior three years.

- Some of the issues the industry has faced this year are likely to leak through into 2024, while other new challenges will present themselves.

- So, what’s around the corner for the container shipping industry in 2024?

Low Scrappage Weighs on Rates

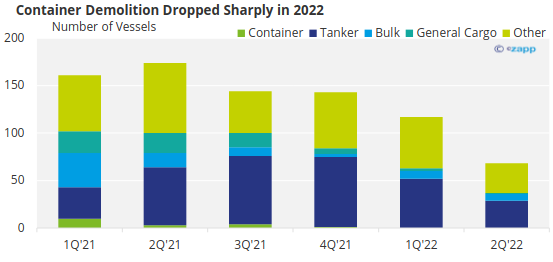

In 2022, the number of container vessels scrapped dropped to almost zero. As freight rates plunged and new environmental regulations were being discussed, there was a reluctance to part with older ships.

Source: Lloyds List

And in 2023 to August, only about 57 ships were sent for scrapping for a total of 110,000 TEU. This is a very slow rate, according to shipping advisory Braemar, and the second half of the year is expected to be just as slow. About 160 ships are expected to be scrapped in 2024.

As a result of this reluctance to recycle, BIMCO says that the container fleet’s average age has increased to an all-time high of 14.2 years, with 21% of carriers now older than 20 years.https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry

This could indicate that a wave of demolitions is on the horizon, which would reduce the size of the fleet and therefore this lower availability could lend support to prices.

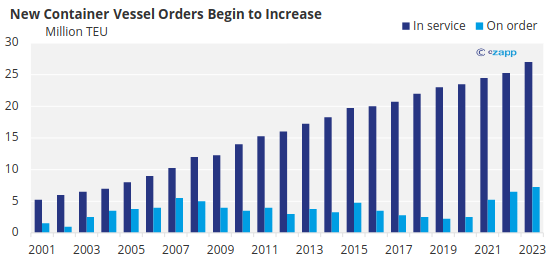

But newbuilds coming in too. An analysis by S&P Global shows that the total number of container ships on order has edged up in recent years.

Source: S&P Global

The number of newbuilds coming onto the market outnumber the number of scrappages, meaning the container fleet is getting bigger. But it is also getting older, and this could lead to a lack of supply later down the line. This means that, if global economic growth notches up, the picture could change dramatically.US Department of Transportation

Weather Impacts Will Continue

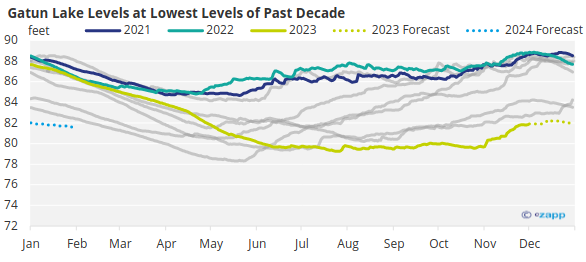

In 2023, water levels at the Panama Canal reached new lows, and draft restrictions were imposed. In July, a new draft restriction of 44 feet (13.4 metres) was imposed and is currently still in effect.

Since then, the situation has not improved. According to the Panama Canal Authority, October 2023 was the driest October since records began 73 years ago, with 41% less rainfall than usual.

And current projections show that water levels will continue to decline into 2024, which will inevitably lead to more restrictions, higher surcharges and longer queues.

Source: Panama Canal Authority

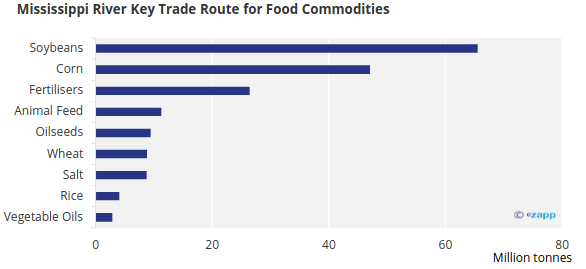

To the north in the Mississippi River, which runs down the centre of the US with major tributaries in St Louis, Memphis and New Orleans, has been experiencing low water levels for another year. The river is a key trade route for several food commodities – mainly corn and soybeans, as well as fertilisers.

Source: US Department of Transportation

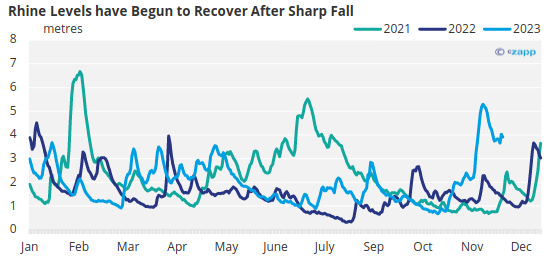

Across the Atlantic, the inland waterways of the Rhine have reached critically low levels for another year, creating delays and disruption. The Rhine is a key trade route that distributes food and fertilisers across Europe.

The measuring station at the town of Kaub is considered a decisive water level measurement given that it is located at the shallowest part of the Middle Rhine and is a crossing point for freight from the North Sea to reach southwest Germany.

This year, water levels were extremely volatile – going from very low levels in summer to unusually high levels at the end of the year. Of course, this has impacts on trade and surcharges are imposed when the water drops below certain levels.

Source: Contargo

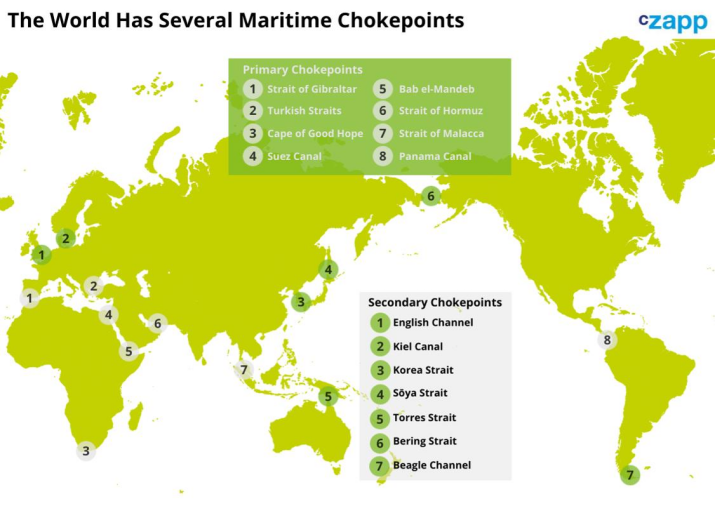

In 2024, volatility at key crossings is bound to continue and it may even knock on to other routes. The Suez Canal, an alternative route to Panama for vessels travelling from the Americas to Asia, is bound to face higher volumes of traffic as chokepoints worsen and operators seek alternative routes.

Conflicts Feed into Containers

As the year drew to a close, the Russian invasion of Ukraine raged on. But it became a secondary focus for the global community after another war broke out on the Gaza Strip in Palestine. While neither Israel nor Palestine are known as large players in the food supply chain, the war has forced shipping firms to take note.

Firstly, there are two ports that are situated within close proximity to the centre of the conflict in Gaza.

There have also been reports of attacks on Israeli vessels, including a seizure by Yemeni Houthis – which support Palestine – on November 19. The attacks tend to be focused in the Persian Gulf, the Strait of Hormuz and the Gulf of Oman. The Strait of Hormuz has become particularly busy as operators re-route cargoes though the Suez Canal.

There has also been fallout from Russia-Ukraine. At the Concluding Thoughtsbeginning of November, there were reports of a Russian strike on a ship in the Black Sea port of Odesa. This came after Russia pulled out of a grains deal earlier in the year. Although grains trade continues in the Black Sea, the risk for shippers is elevated.

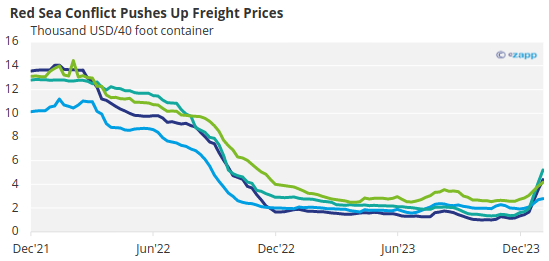

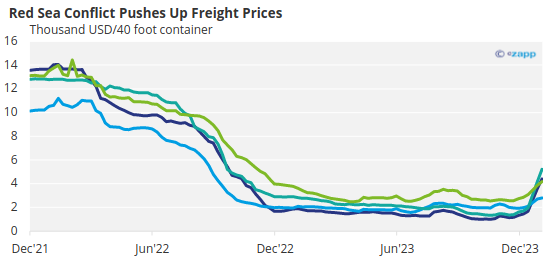

The conflict in the Red Sea has recently pushed freight prices up quite substantially and abruptly.

Source: Drewry

But in 2024, this activity is also bound to create a substantial increase in insurance premiums and lower availability of ships for certain routes as owners try to avoid risk. This could mean elevated freight rates on certain, more volatile trade routes.

Consolidation for the Industry

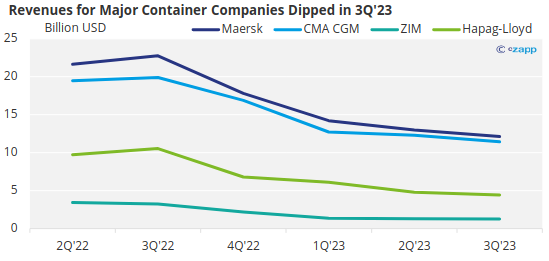

Throughout 2023, it was clear that the boom years for major shipping firms were over. In several companies’ third-quarter earnings reports earlier in the year, most shipowners announced dropping revenues.

Maersk announced it had “imposed rigorous cost containment measures” during the year, and this included staff layoffs in the range of 7,500 people. It said in its third-quarter results that further redundancies would be required, bringing its headcount down below 100,000 from 110,000 in early 2023.

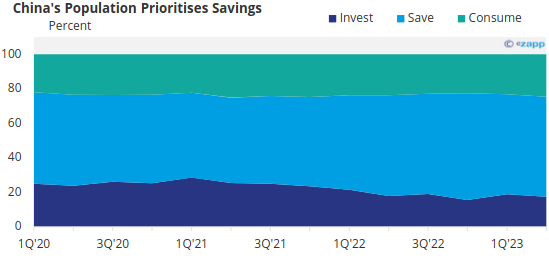

Container companies felt the pain from low demand in most consumer markets, particularly China. Consumption suffered in 2023 as the population recovered from strict lockdown measures and prioritised saving over spending.

Source: PBC

Freight rates have recently soared due to the conflict in the Red Sea but it is unclear whether these higher prices will be sustained in the long term.

Source: Drewry

While Maersk imposes staff headcount reductions, other companies may look to other avenues to optimise services in 2024: M&A.

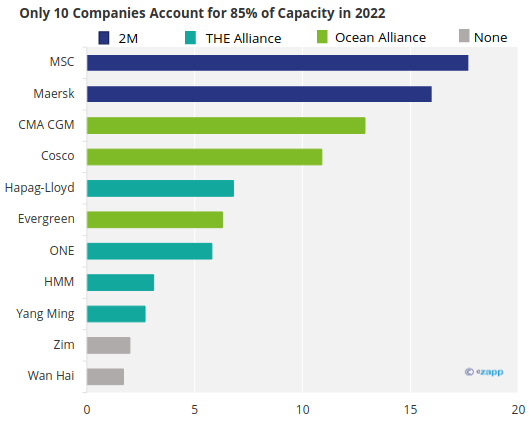

After the Great Recession, stagnant freight rates drove many container companies to strike up alliances. First, the 2M Alliance was formed between MSC and Maersk, followed by THE Alliance and Ocean Alliance. Now, 10 companies are responsible for over 80% of shipping capacity.

Source: Alphaliner

Although MSC and Maersk announced that they would not continue their partnership beyond 2025, the environment in shipping makes it much more beneficial to be part of a large group. It is therefore unlikely that other firms will follow suit. On the contrary, we are likely to see more alliances in 2024 as rates remain low and companies try to find a competitive advantage.

Concluding Thoughts

- The container shipping industry has endured some challenges in 2023, but the beginning of 2024 has seen freight rates rise sharply.

- The root of the industry’s problem is low demand, and this is unlikely to change in the next year as the world struggles to avoid a recession and interest rates remain elevated.

- However, conflicts and availability could continue to provide support for prices for the foreseeable future.

- Volatile weather will continue to present issues for shipping as maritime chokepoints intensify.

- But some respite could be offered by industry consolidation, which would provide smaller operators some protection against volatility.