Insight Focus

- Colombia announces new health tax on beverages containing sugar.

- Sugar taxes have had mixed results in Latin America.

- Opponents say the tax disproportionately hits the poor.

Colombian President Gustavo Petro has introduced a series of health taxes to help curb sugar consumption. Beverages such as sodas, energy drinks, and other flavoured drinks will be taxed. The tax levied on the beverages will be determined by the amount of sugar per 100 millilitres. When announcing his new fiscal policy, Petro stated, “the tax on sodas is not to raise money. It is so people don’t drink too much soda. A great percentage of people who drink soda get diabetes.”

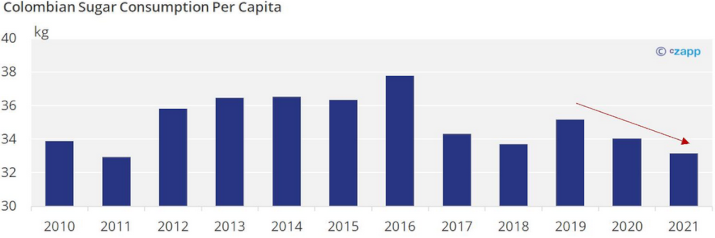

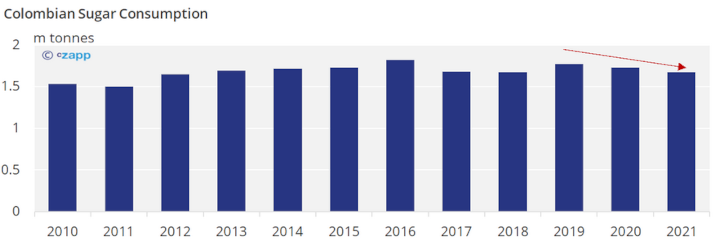

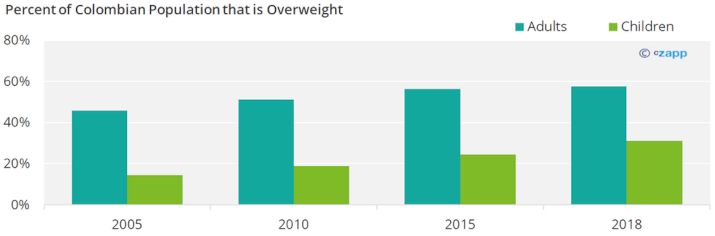

Colombia is the third largest sugar consumer in Latin America. Since 2017, sugar consumption per capita and sugar consumption have decreased in every year except for in 2019. The overweight rate has increased every year since 2005 among Colombian adult and children.

Colombia Sugar Comsumption and Health

Source: Global Nutrition

Other Health Taxes in Latin America

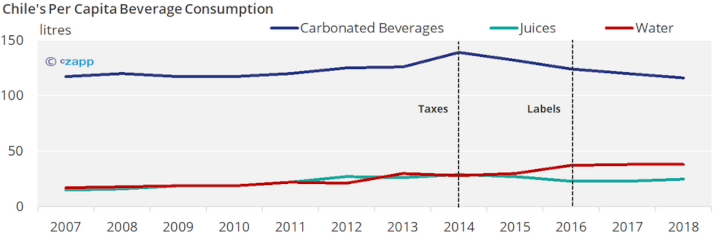

Supporters of the tax cite Chile as an example of successfully lowering sugar consumption. Chile adopted a soda tax in 2014. Since implementing their soda tax, Chile’s per capita sugar consumption has decreased. Also, a study says that between 2014 and 2015, the amount of sugar bought in soft drinks decreased by 21%. It is important to note Chile’s policies of heavily regulating advertisements on children’s foods with high sugar levels and implementing warning labels on these products also contributed vastly to the decrease in sugar consumption. To read more about Chile’s efforts to decrease sugar consumption click here.

Source: CCU

Advertisement of Cereal Boxes Before and After Regulations

Labels Imposed on Products

Source: New York Times

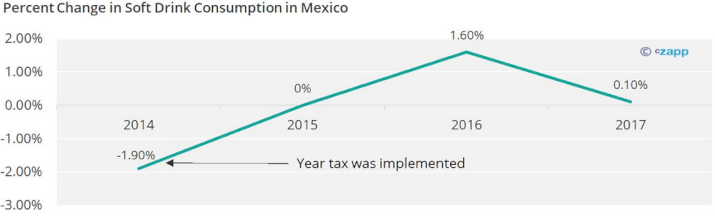

Mexico started enforcing a sugar-sweetened beverages tax in 2014. The change in soft drink consumption in Mexico was minimal after the tax was put into effect. Mexican soft drink consumption only decreased the first year the tax was implemented. The impact of Mexico’s policy was less than expected since the government only implemented the tax and did not restrict advertising and enforce warning labels like Chile did. To read more about Mexico’s efforts to decrease sugar consumption click here.

Source: FoodBev

Socioeconomic Effect of the Health Tax

Those who oppose the new health taxes argue that it could end up hurting low-income households. The opposition says that the proposed tax policy would increase the price of the Colombian family basket. The Colombian family basket lists goods and services needed to survive. Opponents of the bill say the health tax will reduce lower-income households’ disposable income by 8% annually and increase inflation in Colombia by 1.89 percentage points.

Concluding Thoughts

If the government wants to cut Colombian sugar consumption, the Mexican example shows a tax alone may not be enough. The Chilean example shows that a combination of a tax, the regulation of advertising of food with a high-sugar content and labelling can be more effective.

Other Insights That May Be of Interest…

Investors, Regulators Drive Carbon Labelling Agenda

EU Deploys Labelling Rules to Combat ‘Fake Honey’ Imports

Explainers That May Be of Interest…