Insight Focus

- Ukraine spring sowing area could halve.

- Sudanese cereals production plunges 35%.

- New fertiliser plant opens in Nigeria.

The global food supply chain is still counting the cost of the seismic changes caused by Russia’s invasion of Ukraine.

Ukraine spring crop acreage halved

In Ukraine itself, the spring crop sowing area may more than halve this year from 2021 to some 7m hectares compared with the 15m expected before the invasion, Agriculture Minister Roman Leshchenko told Reuters. He added that farmers could sow up to 3.3m hectares of corn this year, down from 5.4m in 2021. Later in the week, Leshchenko resigned and was replaced by Mykola Solskyi, the official Ukrainian news agency Ukrinform reported.

Reuters also quoted the governor of Ukraine’s north-western Rivne region, Vitaliy Koval, as saying sowing of spring crops had started there. He said the region aimed to sow 420k hectares and support regions where the harvest may be more severely disrupted by the conflict.

Ukrainian Grain Association Chairman, Mykola Gorbachev, told Reuters Ukraine faced a possible grain revenue loss of $6 billion as the blockade of its ports by Russian forces prevented it from selling millions of tonnes of wheat and corn that had been earmarked for export by June.

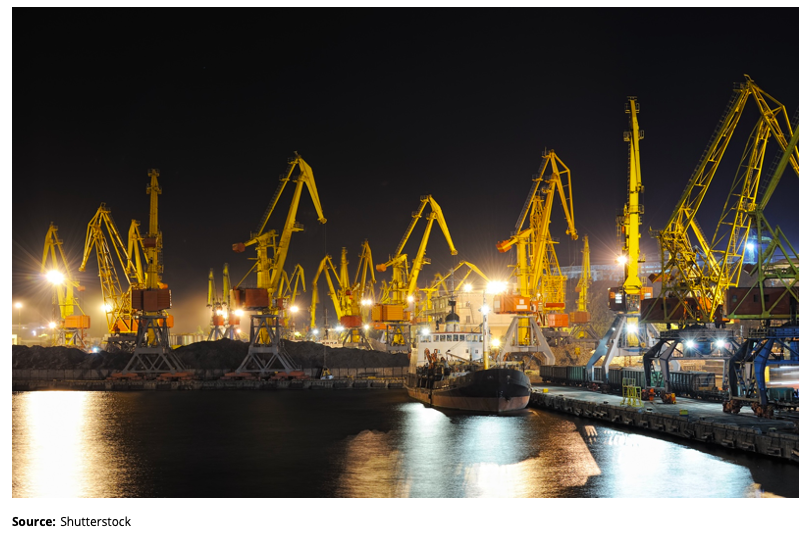

A port manager from the southern city of Mariupol, which has been devastated by Russian bombing, told the BBC that unlike the rest of the city, the port had suffered relatively little bombing. Mariupol is the biggest port on the Sea of Azov and one of Ukraine’s biggest ports for the export of agricultural products.

Russia Still Exporting Grain

In Russia, Deputy Prime Minister, Viktoria Abramchenko, urged people not to panic buy sugar and buckwheat as the country had enough stocks, the Interfax

news agency reported. However, Reuters reported that the government had simplified procedures for obtaining permits for white sugar imports after domestic demand leapt.

The BBC reported that annual inflation in Russia hit 14.5% in the week to the 18th March, largely due to the plunge in the value of the rouble. It quoted the Federal State Statistics Service as saying the cost of sugar rose by as much as 37.1% in certain regions of the country and by an average of 14% nationwide.

Australian website, Grain Central, cited private Russian consultancy, IKAR, as saying that export vessels were being loaded at all five of Russia’s Black Sea grain terminals after a pause of 7-10 days at the beginning of the invasion.

However, Grain Central added it is likely that much of the grain loaded since 24th February was for sales made before the invasion.

Grappling with Disruption

The tensions between Russia and the West are disrupting the work of the World Trade Organization, Reuters reported. Western countries are refusing to engage with Russia at the WTO, which has already disrupted negotiations on agriculture and other areas.

At a national level, Egypt’s Prime Minister, Moustafa Madbouly, set a fixed price for unsubsidised bread in an effort to counter rising food prices after the war in Ukraine closed off access to lower-priced Black Sea wheat, Reuters reported. Egypt sources 80% of its wheat imports from Russia and Ukraine.

Al-Ahram said the Egyptian government decided to grant domestic wheat farmers an incentive of around 23.46 USD/tonne to encourage them to raise the amount they sell to the Ministry of Supply and Internal Trade.

Egypt is also seeking alternatives to Black Sea wheat and is in talks with Argentina, India, France and the USA for future wheat imports but is in no rush to buy at the moment, Reuters quoted Supply Minister Ali Moselhy as saying.

The UN’s Food and Agriculture Organization said that in Egypt’s southern neighbour, Sudan, the 2021 national cereal production (including wheat crops to be harvested in March 2022) is estimated at about 5m tonnes, 35% lower on the year and 30% below the five-year average. Wheat production is forecast at about 600k tonnes, 13% lower than the previous year’s output and the five-year average, reflecting reduced plantings due to shortages of improved seeds and fertilisers, as well as increasing electricity rates affecting pump irrigation.

In North Africa, Director-General of Competition and Economic Investigations at Tunisia’s Ministry of Trade, Houssem Eddine Touati, said cereal imports and purchases were underway, denying any halt to supply, the official TAP news agency reported. Touati, said speculators had taken advantage of the global situation to make people believe that the shortage of raw materials was due to the Ukrainian war, thus causing “a state of panic among the population”.

Lebanon is planning a tender to import 50k tonnes of wheat from India but the timing depends on the Lebanese central bank opening the necessary credit line, Economy Minister Amin Salam told Reuters.

In India itself, government and industry sources told Reuters sugar exports could be limited either by a cap of 8m tonnes or an export levy to prevent a surge in domestic prices.

In Jordan, Trade Minister Yousef Al-Shamali said the country had enough wheat and barley reserves to cover the country’s needs for more than a year, Xinhua reported.

Rich Countries Worry Too

Even rich countries are nervous about security of grains supply. Gulf News said the Saudi authorities had warned of legal action against those who use wheat as fodder for cattle, citing global grain shortages on global markets due to the war in Ukraine.

The rise in global food prices fuelled by the Russian invasion of Ukraine is also causing concern in Europe.

The Financial Times (behind paywall) reported that the EU is reviewing its sustainable food strategy. The paper quoted French President, Emmanuel Macron, as saying the sustainable food strategy was “based on a pre-Ukraine war world” and should be reviewed. EU Agriculture Commissioner, Janusz Wojciecho ski, told the FT he wants to allow farmers to plant the 2.6% of land “set aside” for environmental benefits with crops for animal feed to help offset some of the fall in animal feed imports from Ukraine.

To cut the amount of grain used to feed animals Agriculture Minister, Cem Özdemir, urged Germans to eat less meat. In an interview with Der Spiegel (behind paywall in German) he said: “A system like we have in Germany where 60% of the grain lands in troughs is fundamentally unsustainable.”

By contrast, the Irish government intends to raise grain production by giving up to 400 EUR/hectare to farmers who plant additional grain over and above what would have been there in the previous year, broadcaster RTE reported.

There was some potential relief on the animal fodder front after Argentina’s government re-opened the registration of new soy oil and meal exports hiking the tax rate on the two products, its main source of foreign currency income, by 2% to 33%, Reuters reported.

Cost Rises Hit European Dairy and Sugar

In the UK, dairy cooperative, Arla, warned that rising costs to farmers could threaten milk supplies. Arla Foods Managing Director Ash Amirahmadi told the BBC that with cost increases of some 36%, farmers were facing some hard decisions and that they needed confidence to continue producing.

In the sugar sector, the International Confederation of European Beet Growers (CIBE) said the rise in costs for beet growers needed to be passed along the entire food supply chain. It said fuel and fertiliser prices had risen 20-25% because of the war in Ukraine. The CIBE warned that a further shrining of the beet acreage in the 2023/24 season would lead to a beet supply crisis in several regions of Europe.

Fertilizer Supply

Nigerian billionaire, Aliko Dangote, opened a 3m tonne a year fertiliser plant, Reuters reported. Dangote said exports from the plant, which produces urea, would go to Brazil, which relies heavily on Russia for imports of fertiliser.

In Algeria, four local and Chinese companies have signed a deal, worth nearly $7 billion, to develop an integrated phosphates project, which will develop and exploit the phosphate deposit of Bled El Hadba, Djebel Onk, Tebessa. It will also include the transformation of phosphates into fertiliser, as well as the construction of port facilities at the port of Annaba, Mining Technology reported.

Other Insights That May Be of Interest…

Russian Invasion Could Make India a Major Global Wheat Player

Russian Invasion Sparks Packaging Shortage for Food & Bev Producers

Explainers That May Be of Interest…