Insight Focus

- Despite rising food prices, US farmers have been squeezed by tightening margins.

- An end to Covid-related disaster payments and high debt burdens are increasing pressure.

- Now, drops in the price of key crops corn and wheat could push them to breaking point.

Food Price Rises Don’t Translate to Farms

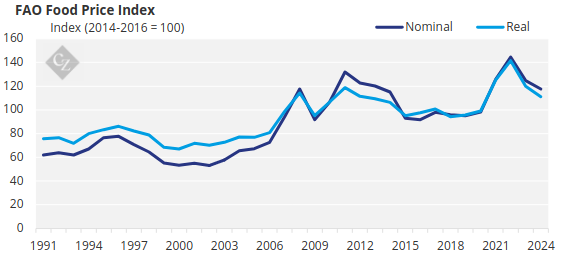

Inflation has been one of the biggest talking points of the past few years. Food prices shot up between 2020 and 2022, according to FAO data, and they remain elevated from pre-pandemic levels.

Source: FAO

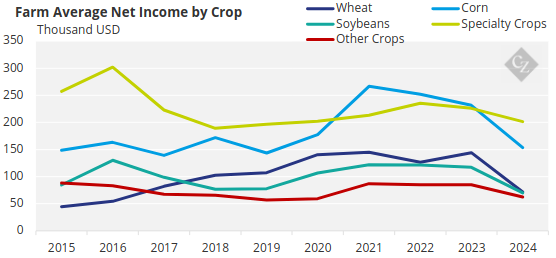

But at the same time, the price farmers are able to sell products for has largely stagnated. In the US, average farm incomes have remained flat or even dipped in some cases.

In 2024, wheat farmers recorded an average income of USD 71,600 – up 61% since 2015. However, corn incomes have risen by just 3.4% to reach USD 153,600 in 2024, while soybean incomes actually declined by 17% to USD 70,100, according to USDA data.

Source: USDA

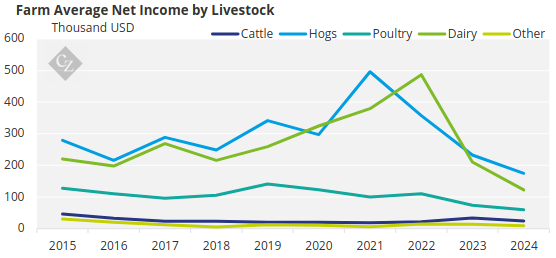

The situation is even worse for livestock farmers. For every livestock category including dairy, the average US farm income has declined since 2015.

Source: USDA

Expenditures Rise

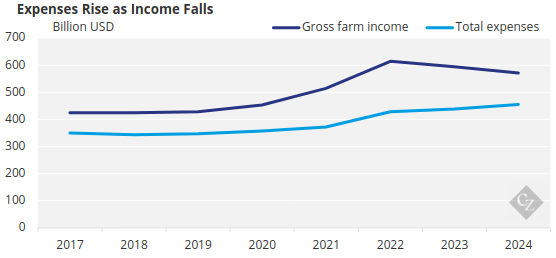

While income has stagnated or fallen on US farms, expenses have risen.

Source: USDA

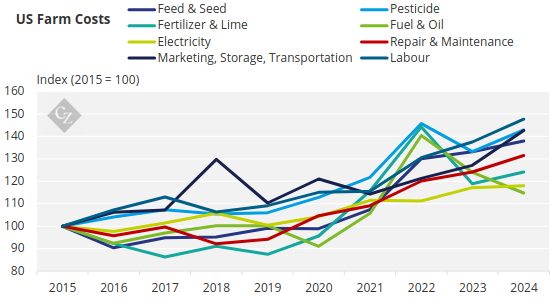

Costs for US farmers have risen across the board. Expenditure has risen exponentially for farmers due to rising input and energy costs, as well as storage, transportation, repairs and labour.

Source: USDA

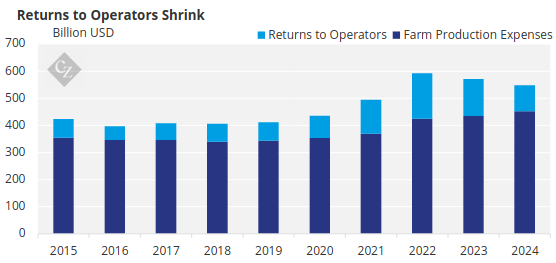

As a result, returns to operators is shrinking – although these are still higher than returns in the 2015–2020 period.

Source: USDA

Other Income and Expenses

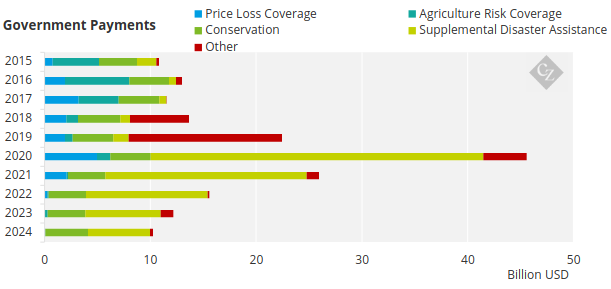

Direct incomes from crops are not the only way US farmers make money. They also can obtain risk and price loss payments from the federal government.

During the pandemic, government payments increased. Supplemental disaster assistance – mainly Covid-related – reached USD 31 billion in 2020 but has steadily been declining. Total government payments to farmers in 2024 are expected to be lower than 2015.

Source: USDA

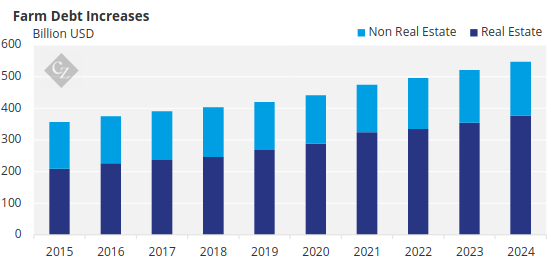

Debt on farms is also rising. Not only this, but the USDA projects that debt-to-asset levels in the sector will worsen to 12.78% in 2024 from 12.73%. This means the amount of debt on farms is growing faster than the value of assets.

Source: USDA

Young People Shun Profession

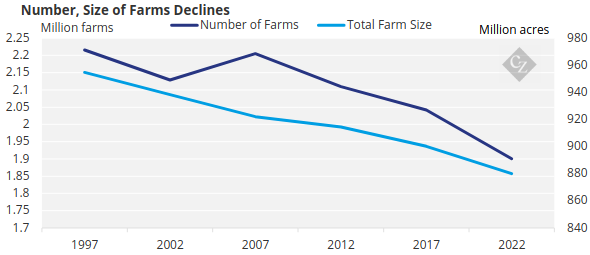

Against this backdrop, farming is becoming a less attractive profession, and this is evidenced by the decline in the number of farms in the US. Both the number of farms and the total farm size has dropped since 1997.

Source: USDA AgCensus

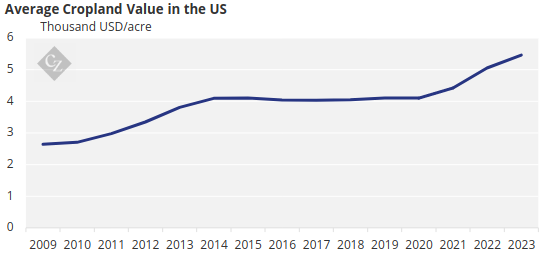

But there’s a very valuable asset held by farmers: land. A report by the FT highlights that investors are piling into farmland due to scarce resources and a growing population. But investors still own a small proportion of US farmland, with 95% of all farms owned and operated by families.

Source: USDA

While farmland has inherent value, it still requires the input of those that know how to work the land to generate any meaningful output.

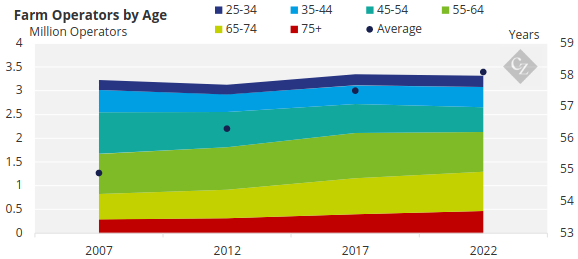

But it seems that farmers will become even scarcer. According to USDA data, farm operators are ageing. Due to the financial pressures of running a farm, fewer young people are embarking on this career path, which puts the future of the sector at risk.

Source: USDA AgCensus

More Challenges Ahead

Both wheat and corn prices have plummeted in the past two years. Corn traded in Chicago dropped below USD 4.50/bushel in 2024, down from USD 7.50/bushel in the first quarter of 2022.

Wheat prices tumbled to around USD 5.50/bushel in March 2024, down from highs of around USD 14/bushel two years earlier.

Given that farmer margins are already tight, declining crop prices will weigh heavier on the profession.

Concluding Thoughts

- Farming is becoming more challenging due to rising input costs and tight margins.

- There is a premium on farmland – but the returns for operating a farm are not so lucrative.

- Farmer populations are ageing as younger generations don’t see the profession as sustainable.

- There are further challenges ahead with a weakening of corn and wheat prices.

- More needs to be done to support the US farming industry.