Opinion Focus

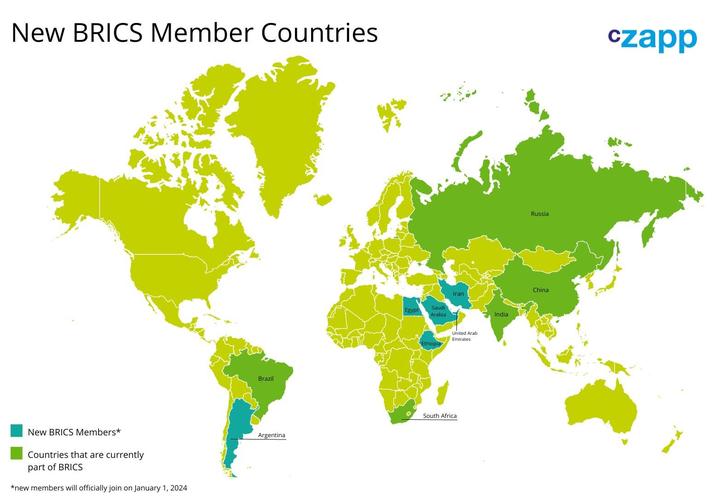

- Six countries will join the BRICS in January 2024, including Saudi Arabia and Argentina.

- The expanded BRICs will represent 37% of global GDP and 32% of the planet’s area.

- Agricultural trade and investments in renewable energy and logistics could grow.

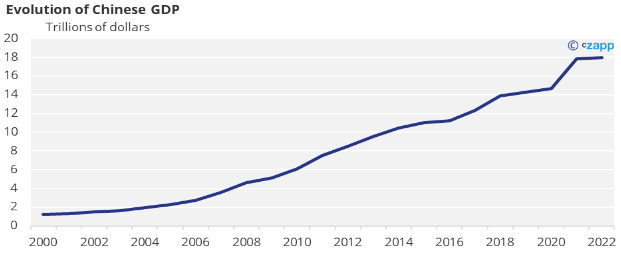

After years of discussions and a lot of behind-the-scenes talk, the new BRICS, with six more countries, will be made official on January 1st, 2024, with repercussions for global trade and geopolitics. The expanded BRICS (joined by Saudi Arabia, Argentina, Egypt, United Arab Emirates, Ethiopia, and Iran) will represent around 37% of global GDP, 32% of the planet’s area and almost half of the world’s population. Today, the bloc (with Brazil, Russia, India, China, and South Africa) accounts for a quarter of international trade and around 26% of the global economy, with emphasis on China and India.

Source: Federal Reserve (FRED) St. Louis

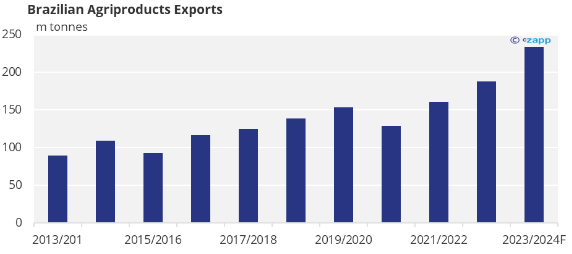

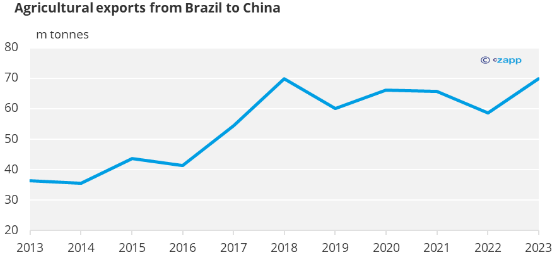

In agribusiness and other areas, the new BRICS should gain a lot of ground. In the last decade, agricultural trade between the bloc’s countries has expanded strongly. Food trade between the current bloc countries totalled around USD $588.3 billion in 2021, 128% more than in 2010.

Argentina’s arrival at the BRICS will expand the strength of agribusiness in the bloc. Historically, Argentina is the largest global exporter of processed soybean oil and meal (the country may lose world leadership this year due to a prolonged drought, but estimates indicate a recovery in 2024). Meanwhile, Brazil is the largest exporter of grains and sugar.

Source: USDA

But the news is not limited to exports. The bloc should also have large importers. A good example is Saudi Arabia, the largest economy in the Arab world. Last year, the country imported around USD3 billion in food, 23% more than in 2021, according to the USDA. By 2030, investments in the Saudi food processing industry could exceed USD70 billion, making the country the largest player in the sector in the region.

As well as the expansion of agricultural trade, new investments might also be made in areas such as transport infrastructure, essential for improving export logistics.

The energy sector, with emphasis on renewable sources, should also go through a new phase of expansion, especially with investments from China in Brazil and partnerships between the other countries in the bloc. Countries such as Saudi Arabia and the United Arab Emirates estimate that at least 44% of their energy matrix will come from renewable sources by 2050.

Agricultural exchange between BRICS countries should increase. Photo: iStock.

But there are also challenges. The new BRICS could become a counterpoint to the dynamics of Western countries. It is no secret, for example, that China and other BRICS members are discussing the creation of a single currency and the use of the yuan, the Chinese currency, for commercial exchanges.

To discuss the impact of the new BRICS on the global agenda, we spoke with Hsia Hua Sheng, professor of international corporate finance at the São Paulo School of Business Administration at Fundação Getúlio Vargas (FGV-EAESP). See below the main excerpts from the interview:

Hsia Hua Sheng, professor at Fundação Getúlio Vargas. Publicity photo/Fundação Getúlio Vargas.

How should the new BRICS affect international trade and agribusiness?

The current BRICS already has a very large weight in relation to global GDP. The new countries that will join the bloc are a very important addition, even from a geographic point of view. The Middle East is a link in the trade route between Brazil and China. Furthermore, the new member countries have a very large renewable energy potential, especially in terms of solar and wind energy. The new BRICS will also be a large bloc of food consumers and producers. Technological innovation and the transition to a green economy are also expected to gain momentum.

China has already been investing in renewable energy in Brazil, right? Should investments increase?

China has been doing this in Brazil and in other countries that will form the new BRICS. There is a great partnership between China and the Middle East. Middle Eastern countries and especially those that are new members of BRICS have technical partnerships with China, Russia and India. In Brazil, there is also great potential in relation to renewable sources, with emphasis on green hydrogen. There are very clear common objectives among the new BRICS members on renewable energy. There are even guidelines for making investments and joint cooperation in the sector.

What should Brazil’s strategic role be in the context of the expanded BRICS?

Brazil is very important from both an economic and geographic point of view. Thinking specifically about the energy, agricultural and biodiversity sectors, Brazil is the most important country in the bloc. There is the issue of food security as well, since Brazil is a large supplier of food to China.

Source: Comex.

Is one of the objectives of the new BRICS to increase transport infrastructure in member countries?

Yes. There has been news in this regard in the Middle East and the region is developing systems such as air transport and train connections. There are partnerships between some countries in the Middle East and North Africa with China for high-speed train projects. There are also cargo transport initiatives that facilitate the region’s connection with Europe, the rest of Asia and Russia.

In relation to agribusiness, can Brazil export products with greater aggregate to China and other countries in the bloc?

The idea that Brazil only sells commodities is something that is becoming a thing of the past. Today, large Brazilian companies, such as JBS and Marfrig, are looking to sell directly in China, to end consumers or companies. This is even happening in relation to soybeans, which are already starting to be sold to local distributors and not just large trading companies.

And how can Brazilian exports to China evolve?

In the future, it is possible that Brazil will participate in China’s crushing soybean industry through direct investments. The cellulose market is another major agribusiness line that has been migrating to products sold directly to Chinese consumers in a low-carbon context, with products that are the result of reforestation. They are not elementary products. Brazilian companies have innovated and helped companies in China change the way they produce to meet decarbonization goals. And, as a result, the profitability of Brazilian companies increases. There is a premium for these products.

Finally, how do you assess the possibility of creating a common BRICS currency? Can this come to fruition?

There is a very clear trend towards regionalization of commercial blocs, even as a result of the reorganization of the global economic order. In addition, there is the weakening of the dollar for several reasons. The United States has a high public deficit, a growing interest rate and there is also the geopolitical issue, as the country has used the dollar to sanction countries. All of this helps to weaken the currency.

But global trade will continue to grow. In the context I mentioned, regional currencies have gained strength. Among the BRICS countries, the most internationalized currency, even due to its importance in global trade, is the yuan, from China. But the dollar should continue to be used. The Chinese currency should be something complementary to the dollar. And it is also worth remembering that there is an offer of credit linked to the yuan, which helps the Chinese currency. Today, the yuan is already the second most used currency in international trade.