- Mexico should produce 4m tonnes of orange this season, up 40% year-on-year.

- The country has received plenty of rain following last season’s drought.

- Consumption is also showing signs of recovery as COVID restrictions start to ease.

Orange Production Rebounds Following Drought

- Mexico should produce 4m tonnes of fresh orange in 2020/21, up 40% year-on-year.

- The country’s received plenty of rainfall following last season’s drought.

- We initially thought we’d see a larger rebound, but COVID weakened producer cash flow and they spent meant less on fertiliser, pesticides, etc.

- Also, many of Mexico’s orchards aren’t irrigated, so land recovery has been slower for some of the smaller producers.

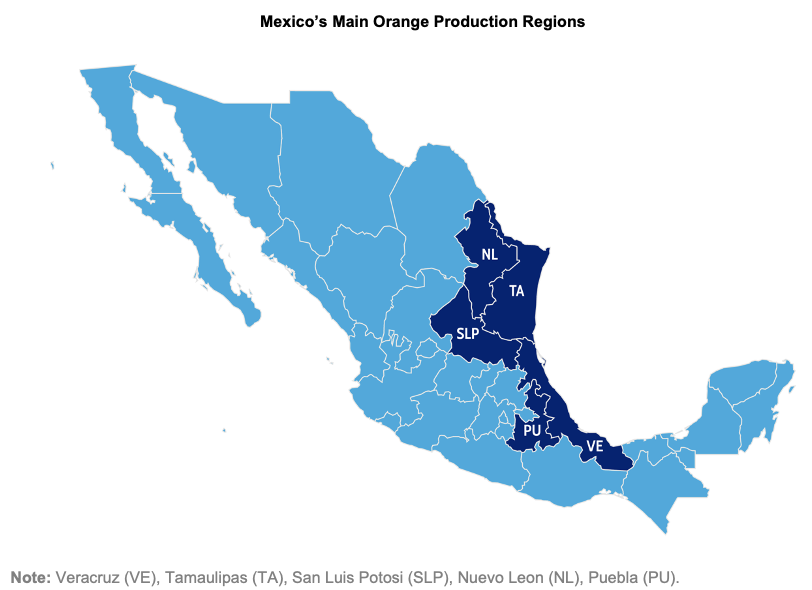

- Yields should average 13.3mt/ha but this will vary on a regional basis due to different weather patterns, fertiliser application rates, tree density and soil health.

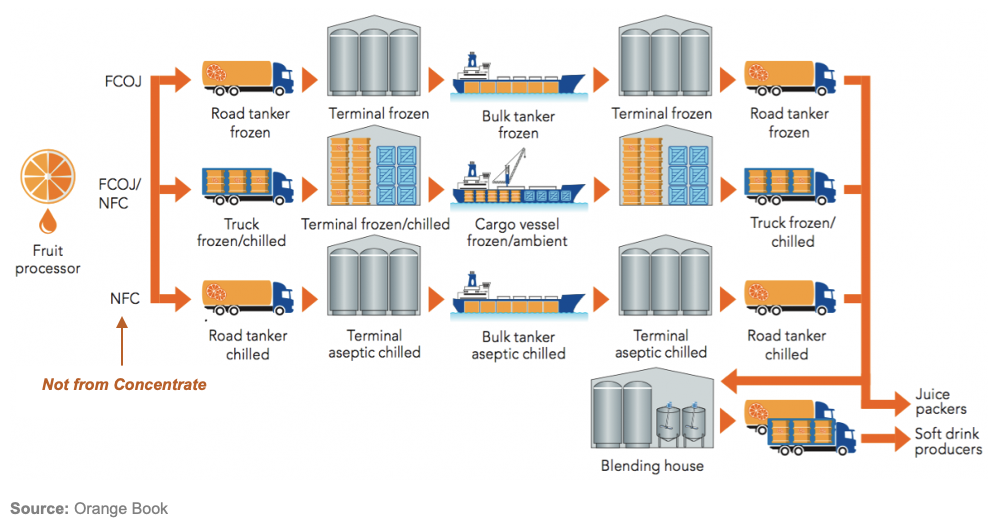

- With strong production on the cards, Mexico should produce 200k tonnes of FCOJ in 2021, up 122% year-on-year.

- However, demand for fresh juice is increasing, meaning many producers are keen expand their production there.

- The process itself isn’t too difficult, but delivery can be challenging as fresh juice requires sophisticated and expensive refrigeration equipment for storage and transport.

Consumption Improves Alongside Production

- Mexico should consume 1.97m tonnes of orange in 2020/21.

- This is a 23% increase year-on-year yet below average as COVID-19 has weakened demand.

- Mexico’s hospitality industry has suffered throughout the pandemic, meaning out-of-home orange consumption is still lower than usual.

The US Remains to the Dominant Buyer

- Although domestic demand is still recovering, Mexico should export 61k tonnes of orange in 2020/21.

- Most of this should go to the US.

- The freight is cheaper and, since 2008, Mexico’s not had to pay any duty due to the North American Free Trade Agreement and now the United States-Mexico-Canada Agreement (USMCA).

- Between 2008-19, Brazil paid $548 million in tax, whilst Mexico paid none of the $405 million it would have otherwise owed.

- Some could also go to the EU via the Mexico-EU free trade agreement (15% duty), but the US is the preference for most.

- As for imports, we think Mexico will take 30k tonnes of duty-free orange from the US to make up for shortages in the disease-hit border region.

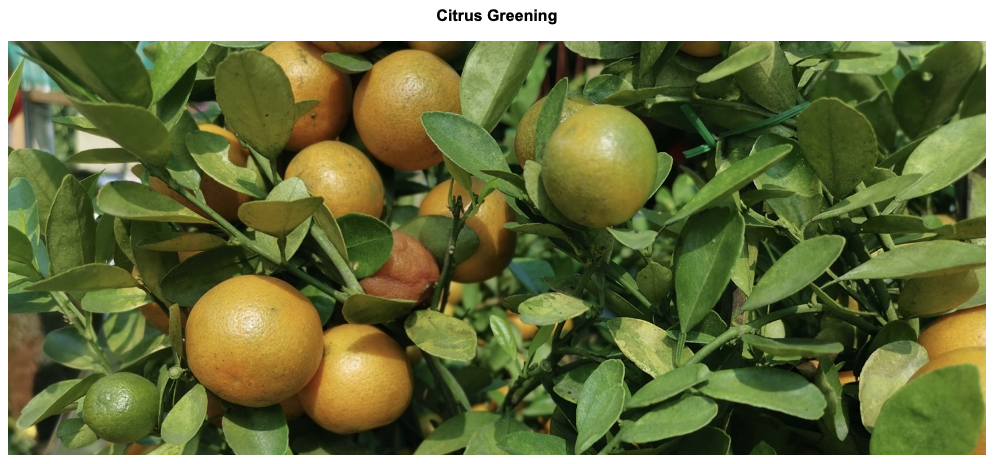

Citrus Greening is Still Causing Problems

- Citrus greening is still an issue in Mexico.

- This disease is spread by psyllids, which feed on the stems and leaves of orange trees, infecting them with the bacteria that causes the greening.

- This greening impairs the trees’ ability to take in nourishment and ultimately results fewer, smaller fruits.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

- Czapp Explains: The Mexican Sugar Industry