Insight Focus

China dairy demand keeps NZ pricing firm despite strong supply. US faces headwinds from tariffs and trade friction. EU surplus masks fragility, with BTV and currency shifts in play.

China Still Buying Despite Surplus

New Zealand’s March milk collections rose 0.8% year-on-year to 174 million kgMS (kilograms of milk solids), closely in line with our forecast from last month.

Despite strong supply, which is typically a bearish factor, New Zealand is benefiting from a near-perfect storm this season. Global buyers are applying a tariff-risk premium to NZ over US origin and an infection-risk premium over EU origin. For instance, NZ-origin SMP is trading at a USD 300/tonne premium to key competitors. This is happening at a time when NZ’s seasonal offer volumes are at their tightest, further supporting prices. As a result, GDT Event 379 increased by 4.6%, reaching a three-year high.

GDT forward curves price this in, with a big drop expected once NZ supply begins for the next season (Sep/Oct ETD). GDT availability for May and June is low, with a further 2% decline signalled for the June GDT events.

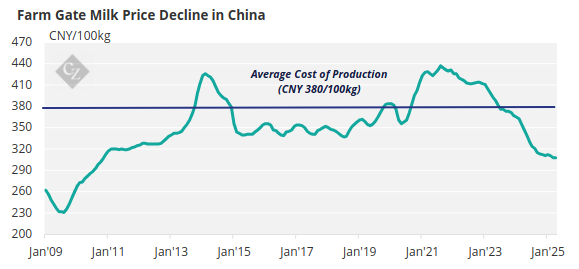

According to the Chinese Ministry of Agriculture and Rural Affairs, milk production reached 8.92 million tonnes in Q1 2025, up 1.7% compared to Q1 2024, despite Chinese milk prices being at a 15-year low. As highlighted in previous articles, traditional economics do not apply as directly to China.

Since 2018, Beijing has aimed to rejuvenate the Chinese dairy industry to achieve greater self-sufficiency, but local demand has not kept pace with the increased supply. Dairies are now being guided to “develop dairy products suitable for Chinese tastes and ethnic dairy products.”

Source: CLAL

Even so, China still requires imports, and New Zealand has long been the preferred origin. With increasing risks to its main competitors, New Zealand is seeing even stronger demand from its top dairy market. Anecdotally, New Zealand has shaped Chinese consumer perceptions of “high-quality” dairy, particularly with a preference for yellow-coloured butter and cheese. Chinese dairy cows are typically grain-fed, resulting in whiter products, as they lack the beta-carotene found in grass that gives New Zealand dairy its more yellow tinge.

Yellow butter from New Zealand is at maximum production, and we expect Open Country Dairy’s new butter plant to be fully sold as soon as it starts in the coming month. The key question now is how New Zealand will handle its milk protein supply. How can it avoid producing the widely supplied general trade SMP Medium Heat, which is abundant across all origins?

Many New Zealand suppliers are focusing on higher-value specifications like UHT grade, low spore and High Heat, which are less commonly produced by other origins. High Heat is in strong demand in the Middle East and Africa, while UHT/Low Spore products are primarily sold into Malaysia, a market well aligned with New Zealand’s origin.

The two points above explain why demand from Southeast Asia and China remains strong on GDT, accounting for 44% of WMP sold volume and 38% of total GDT sales.

Fonterra Production Capacity Under Scrutiny

While China pulls demand, New Zealand’s ability to meet it hinges on production, and this is where Fonterra is lagging. Fonterra is not on track to meet its seasonal projection of 1.51 billion kgMS, hindered by a weak performance in the North Island. We now expect their forecast collections to be revised down to 1.504 billion kgMS.

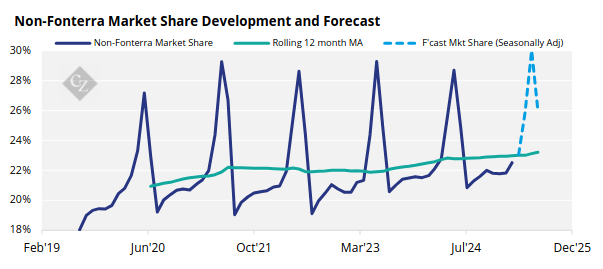

The non-Fonterra group exceeded expectations, growing 2.7% year over year and capturing 22.5% market share in March. We expect they will continue to increase market share throughout the winter months, following trends from previous seasons.

We are now predicting New Zealand’s national milk production for April to be approximately flat year over year at around 149 million kgMS.

While April saw above-average rainfall in most key dairying regions, soil moisture remained well below normal in Waikato and Taranaki, raising concerns in the central and western dairying heartland. In May, heavy storms have hit the country, with parts of Canterbury placed under a state of emergency due to flooding. Many farms will soon begin drying off, so the main impact will be felt next season, with pastures likely well-prepared for spring growth.

Temperatures across the country were above average, with the national average 0.8°C higher than normal. This warm, wet and sunny trend has supported strong pasture growth and thus milk flows, where soil moisture has not been limiting. While forecasts of ENSO-neutral conditions reduce El Niño concerns, short-term regional weather variability remains critical.

Global Commodity Volatility Could Impact

Trade wars, geopolitics and erratic central bank policies are amplifying price fluctuations across commodities, yet dairy demand remains resilient for now.

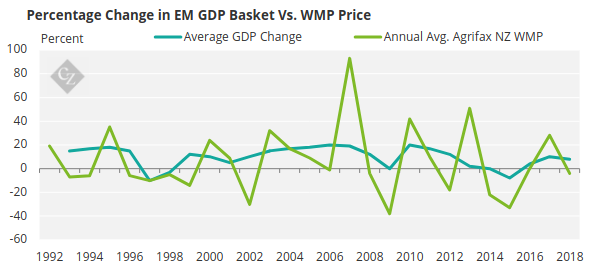

The latest Algerian Government tender (ONIL) covered 15,000 tonnes of SMP and 23,000 tonnes of WMP (July-Oct), reflecting steady demand from emerging markets. My analysis shows that WMP prices moderately correlate with the GDPs of key emerging markets, with crude oil playing a significant role in the GDP of many, though not all, of these markets.

A potential risk is that a dip in oil prices could pressure the purchasing power of emerging markets.

Proposed USD 1 million port fees for Chinese-made or operated ships in US ports also threaten an 8% drop in US dairy exports, according to the IDFA.

S&P Global highlights that Chinese-built ships carry a significant portion (46% in 2024) of US dry bulk exports, including dairy. Higher fees could lead to increased shipping costs, port congestion and capacity reductions, disproportionately affecting US dairy exporters dependent on Chinese vessels.

Globally, this policy may disrupt trade flows, raise freight rates and strain supply chains, potentially increasing costs for both dairy importers and exporters. The US shipbuilding industry’s inability to replace Chinese capacity in the short term could exacerbate these challenges.

Strength Becomes a Weakness for EU

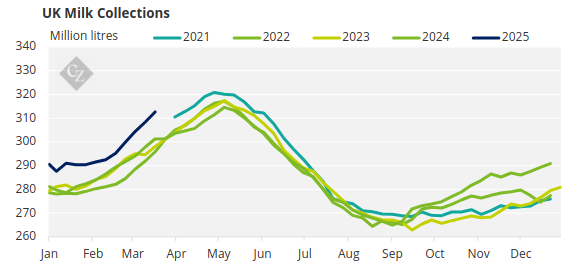

The UK and Ireland are enjoying robust milk production, with SMC heading to the EU in large volumes. Prices of EUR 1,400–1,500/tonne delivered are undercutting local skim prices.

The strength of the Euro, driven by tariffs, erodes the EU’s export advantage, particularly against US butter and cheese. A weaker Euro would be bullish for EU-origin products.

However, there is a bullish risk: if BTV hits hard later in the season, the EU could shift quickly from surplus to shortage, and farmers appear to be ramping up production early to mitigate this summer risk.

Whey, Lactose, Permeate Face China Tariff Risk

Whey Permeate

At the ADPI conference, traders, suppliers, and buyers expressed concerns about the future of US dairy permeate exports. A key issue is the 84% retaliatory tariff China has imposed on US dairy products, including whey permeate. In 2024, China accounted for approximately 42% of US whey exports, making it a critical market.

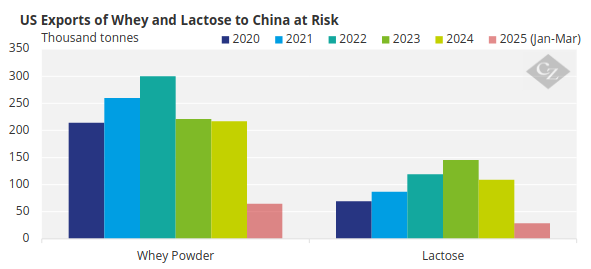

Lactose

The US leads global lactose trade, supplying 58% of exports in 2024, with China as the largest buyer (43% of global imports). However, the 40% retaliatory tariff may reduce US lactose exports to China, though its competitive pricing compared to EU pharma-grade lactose could help maintain some market share even after tariffs are added.

Whey Powder

The retaliatory Chinese tariff is expected to hurt US whey exports more than lactose. China and the US are major trading partners, and according to Rabobank when China imposed a 25% tariff in 2019, US dry whey prices dropped by over 35%. At the time, a decline in China’s swine production due to African swine fever reduced whey demand for animal feed, causing a 55% drop in US dry whey and permeate exports to less than 60,000 tonnes. This time, the risk is greater, as the new tariffs are more severe and US production is increasing due to expanded cheese and whey capacity, adding further pressure on export prices.

Source: CLAL

No Tariff Loopholes

I’ve been asked whether blends of 49% US and 51% EU products, labelled as EU origin, could circumvent tariffs. This seems very unlikely, as the final product must undergo “substantial transformation” in the EU to qualify for EU origin, and China must agree with this interpretation. It’s likely that processes like extrusion into animal feed pellets would be needed for the product to be considered EU origin.

As a result, US producers are now exploring alternative markets to offset potential losses.

Mexican NFDM Outlet at Risk

Mexico is usually the US’ primary outlet for Non-Fat Dry Milk (NFDM), but this channel is at risk due to tariff threats. Surprisingly, Mexican NFDM imports from the US were up 7.9% in Q1 2025, reaching 92,600 tonnes. If tariffs were to bite into this flow, the US will have a lot of SMP to sell.

I understand that with this risk in mind, many suppliers who can are already maximizing their production of Milk Protein Concentrates (MPCs). However, the demand destinations for this are limited. As a further risk mitigant, I expect the US to produce more export SMP. This is something to watch as more of this could start appearing in Southeast Asia, especially in markets with strong ties to the US, such as the Philippines.

Indonesia is a significant market for SMP Medium Heat, but trade tensions between the US and Indonesia are hot. As a result, I expect the EU to focus more on this market in the immediate term.