Insight Focus

- Certain key themes have plagued food markets and supply chains through 2023.

- We take a look at the main issues that have characterised the year.

- Should we expect more of the same in 2024?

2023 has been a rollercoaster year for food markets. Geopolitical events and weather have begun to reshape how food trades globally. We’ve put together a rundown of the major themes of 2023 and we’ll also let you know what to look out for in 2024.

1. Food Affordability Remains Key Issue

The first big theme of the year was food affordability. This trickled over from the previous two years, when huge monetary injections into the economy created more demand than supply and pushed up prices. You can watch our short video on food inflation HERE.

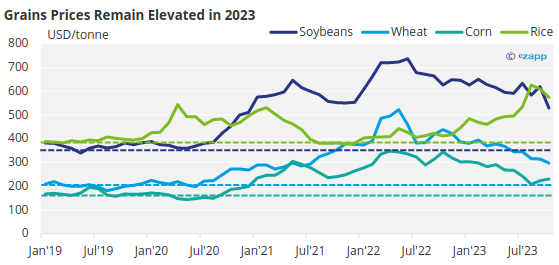

As a result of the distortions between supply and demand, food prices rose. In 2023, though, the money flow stopped, and many were simply left with high levels of food inflation. The price of grains remained elevated for much of 2023.

Note: dotted line indicates 2019 average

Source: World Bank

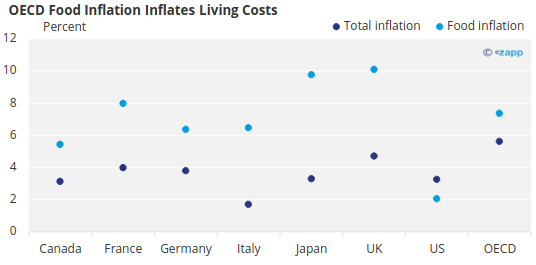

As of October, food inflation in the OECD has reached 7.4% but, in many countries, levels are much higher. In Japan, food inflation is at 9.8%, while the UK has experienced food inflation of over 10%.

Source: OECD

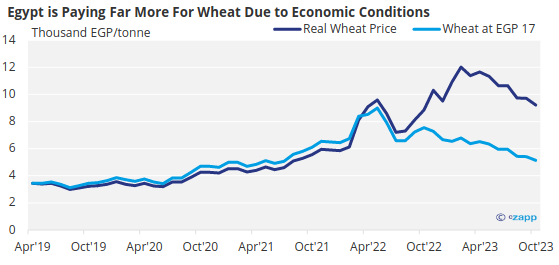

For developing countries, the story wasn’t much better. The US dollar strengthened due to interest rate rises, and this meant countries who buy food in US dollars were paying more in their local currency. Let’s take a look at what happened in Egypt, for example.

Source: Central Bank of Egypt, World Bank

In April 2019, the global wheat price was USD 200/tonne, but now it is around USD 300/tonne. When taking this price rise into account, Egypt would be paying EGP 3,400 in 2019 compared with EGP 5,100 today based on an exchange rate of EGP 17 to USD 1 – its level in 2019.

However, as the dollar has strengthened, the exchange rate has changed and is now over EGP 30. This means that Egypt is paying even more for wheat – around EGP 9,200/tonne. While the amount paid in dollars is unchanged at USD 300, the strain on the local currency is clear.

2. Weather Emerges as Food Market Focus

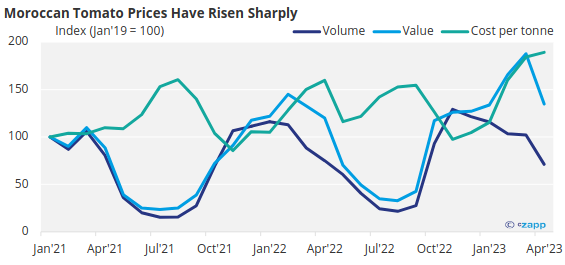

The second main theme of 2023 was weather. Extreme weather events continued throughout the year and jeopardised food production in many markets. Heatwaves in Europe and high Indian rainfall jeopardised tomato supply, in turn pushing up prices of Moroccan tomatoes – a key supplier to the EU.

Source: Eurostat

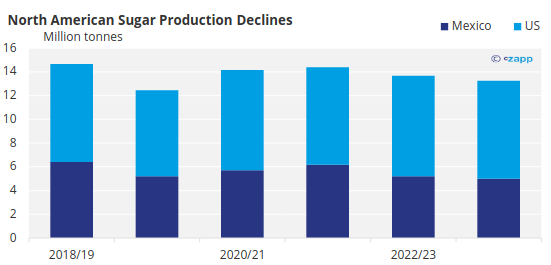

Meanwhile, drought in Louisiana impacted cane production, tightening the supply outlook for this year. The US was also unable to rely on its largest supplier, Mexico, since production and yields suffered due to drought as a result of El Nino.

At the same time, dry conditions in Asia – also caused by the El Nino weather phenomenon — threatened rice yields. You can watch our short video on the impacts and consequences of El Nino HERE.

3. Supply Chain Unravels But Challenges Persist

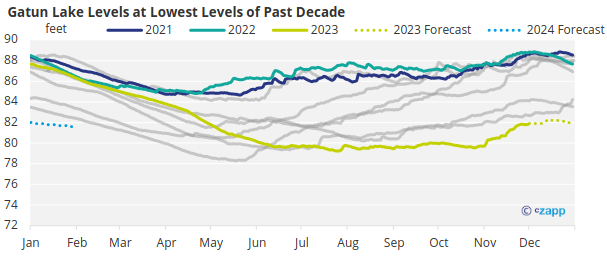

Dryness in the Panama Canal and Mississippi River also created some logistics challenges after draft restrictions were imposed. Gatun Lake is the feeder for the Panama Canal locks, and water levels are at very low levels.

Source: Panama Canal Authority

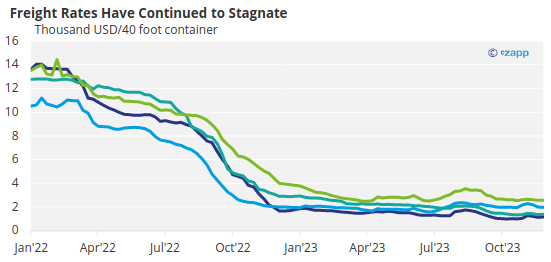

But on the whole, other supply chain issues that were seen in 2020 and 2021 alleviated themselves. Strike activity was largely resolved, port congestion eased, and freight rates took a tumble due to higher availability. Low demand in China became a concern for the freight industry.

Source: Drewry

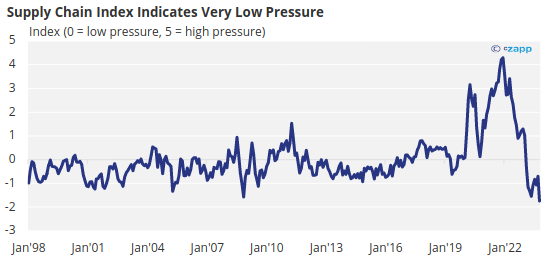

In fact, according to the New York Fed’s Global Supply Chain Pressure Index, supply chains are less stressed than they have been in the past 25 years – even including the end of 2008 when global demand sank due to the Great Recession.

Source: Federal Reserve Bank of New York

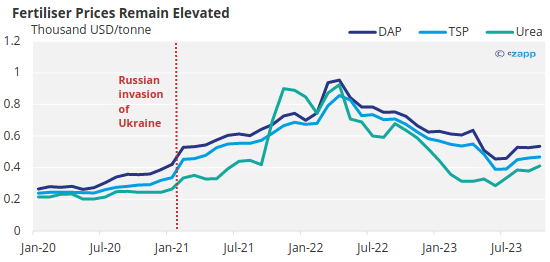

Although global conflict continued between Russia and Ukraine and even escalated in Israel and Palestine, food markets were relatively unaffected. Israel is a fertiliser exporter though, and fertiliser prices have remained elevated since Russia’s invasion of Ukraine.

Source: FAOSTAT

4. Protectionism Ramps Up

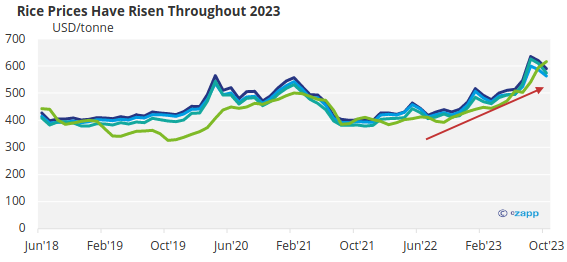

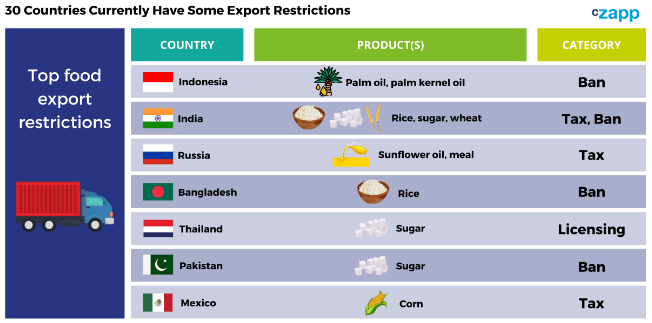

The final theme of 2023 was the increase in protectionist measures across food producing countries, particularly India. In July, the South Asian giant banned exports of non-basmati rice and in October, it extended limits on sugar exports. In 2022, India had already banned wheat exports.

Already, the price of rice is rising globally, which is a concern since it is a staple food in lower-income developing countries.

Source: World Bank

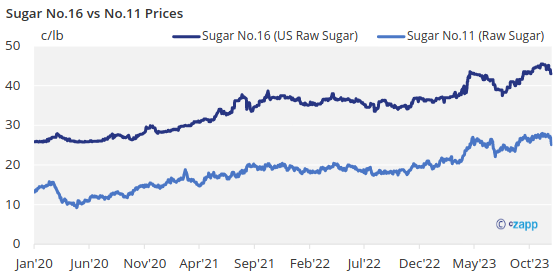

Sugar prices have also continued to rise through 2023.

Meanwhile, Turkiye has banned the export of cooking oil and imposed export licensing on grains and oilseeds. Pakistan and Algeria both banned sugar exports, with the latter also banning pasta, wheat and vegetable oil exports.

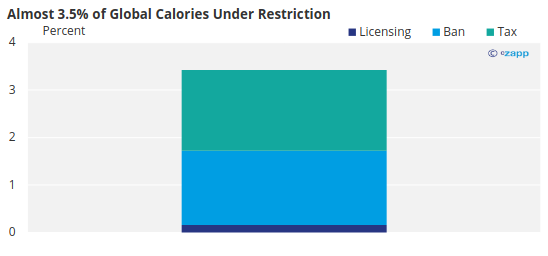

Source: International Food Policy Research Centre

Several other countries have imposed export bans or restrictions. Many of these bans are due for revision at the end of 2023.

What to Expect from 2024

So, what should we expect for 2024? Well, it should be largely more of the same. While global conflict will continue to rage, we should see food prices begin to stabilise and food inflation is likely to fall. Analysts largely expect central banks including the Fed to cut interest rates around mid-2024, which is likely to bring food costs down significantly.

But weather issues will continue to cause headaches for food producers. El Nino is likely to create challenging growing conditions in South America and Asia Pacific. South American farmers will have to contend with wetter weather, while countries in Asia-Pacific will see dryer conditions – which is bad news for rice.

At the same time, weather will complicate processes further downstream in the supply chain. If dry weather persists in key trade crossings such as the Panama Canal, the Mississippi River and the Rhine, voyages will take longer, food will cost more and there may finally be some support for freight rates.