Insight Focus

- China’s growing middle class could underpin future sesame demand.

- Conflict in key African producing countries, logistics and weather are restricting supply.

- In the medium term, the price of sesame is likely to push higher.

Middle Class Population Growth Drives Appetite for Sesame

Sesame seeds are a relatively niche food product, found mainly in Asian and Middle Eastern-origin dishes such as hummus, sesame oil and the confectionary called pasteli.

But sesame has become more popular over the last few years, particularly since it is a staple of Chinese cuisine. Despite being one of the more expensive cooking oils, sesame oil is widely used in China.

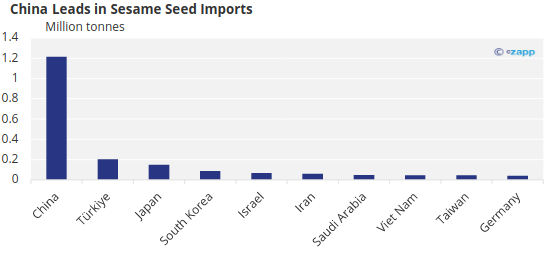

Unsurprisingly, the top import market for sesame is China, by a long shot. Turkiye, where hummus is a popular dish, and Japan, where sesame seeds are used in sushi, follow in second and third positions.

Source: FAOSTAT

As a result mainly of the expanding Chinese middle class population, sesame consumption has increased hugely in the past few years.

Production Challenges Stand in the Way

Perhaps surprisingly, production of sesame seeds is concentrated mainly in Africa, with Asia also playing a large role. Sudan is the world’s largest producer, followed by India.

Source: FAOSTAT

This year, Sudan’s sesame supplies remain disrupted due to the war, and its absence from trade will be felt in the coming season but is unknown as of yet to what extent. Sudan White Sesame Seed, with a loading date in June, has an FOB price of USD 1,960/tonne.

Ethiopia is another major African producer, exporting around 130,000 tonnes last year. But internal conflicts in the northern region, high inflation rates, container shortages and rising fuel costs are impacting sesame shipment from the country. Ethiopian White Sesame Seed Grade A, scheduled for loading in June, had a FOB price of USD 2,030/tonne, while Grade B, also set for loading in June, is priced at USD 1,980/tonne.

Nigeria – the second-largest Northern Hemisphere sesame producer in Africa — was selling the seeds in a similar range of USD 1,700-1,950/tonne FOB. But Nigeria, too, faces challenges. Logistics issues and the rising cost of inputs are making it more difficult for farmers to produce sesame seeds profitably. Additionally, outdated farming techniques hinder productivity, yielding 0.5-1.0 tonnes/hectare, compared to the global standard of 1.4-1.6 tonnes/hectare.

But with competition from Sudan and Ethiopia reduced this year due to conflict, there may be an over-dependence on Nigeria if Tanzania and Mozambique sell out.

Even outside of Africa, challenges face some sesame importers. Only 40-50% of India’s annual production is expected to be exported. India’s production over the past few years has stagnated, exports have declined, and domestic consumption is on the rise. India remains an opportunistic buyer to cover its own shortfall. Indian sesame seems to be offered at an average price of USD 1,845/tonne indicatively and subject to other commercial aspects.

In Pakistan, the price varies with every seller, considering the demand, but the average selling price is around USD 1,725-1,750/tonne FOB. Pakistan has over the last three years become a relevant producer due its sizeable crop. In Pakistan, most farmers have switched to hybrid-type seeds due to quality issues. These now represent over 60% of the total crop, followed by Sindh and thereafter Farmi-type seeds.

El Nino Could Still Impact Crop

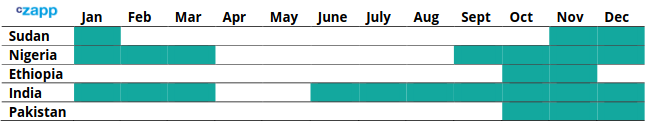

Most sesame growers begin their harvests around the final quarter of the year. Nigeria’s season is from August to March or April, peaking in November to December. In Ethiopia, the sesame seed crop season starts around November or December. In Pakistan, sesame seed cultivation takes place in June or July and harvesting begins in October or November.

In India, there are multiple harvest periods: Kharif, the primary and summer crop, starts around June and lasts until November, and Rabi, the secondary and winter crop, starts in October or November and extends until March.

Sesame seeds crop season in Sudan for 2023/24 will officially start within 10 days.

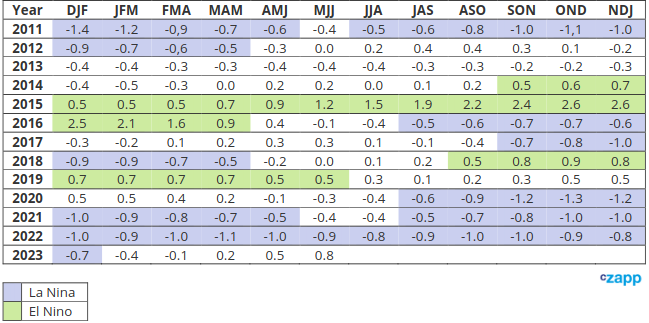

But for farmers everywhere, challenges are being presented by weather conditions and other macroeconomic factors. In the northern hemisphere, disruptions are still expected, especially since El Nino is expected to continue through to at least May 2024.

El Nino and La Nina Events Cause Significant Anomalies in Average Temperatures

But for major sesame growers, weather conditions so far have been favourable, meaning this year’s crop could be sizeable.

In Sudan, the biggest sesame producer, rainfall has been generally favourable so far this year, but there have been some dry spells in some areas. If it continues, it could impact yields. This year, production is estimated to reach 300,000 tons.

The crop in Ethiopia is expected to be good, with production recovering from the effects of the civil war in the north. So far, weather conditions have been generally favourable, and the sowing area has increased compared to last year. The total yield expectation is 240,000 tonnes, with this being 150,000 tonnes of Humera sesame and 90,000 tonnes of the Wollega variety.

Recent projections indicate a surge in sesame seed production in India. After unexpected rain damage led to a drop in production and tighter supplies during the previous Kharif growing season, farmers responded by planting more sesame seeds during the summer growing season. This year production is expected to reach 500-600,000 tonnes, but it will depend on the weather conditions until harvest.

There have been some reports of recent rainfall causing damage to the sesame seed crop in Pakistan, which could impact yields in some areas, which on average are around 250kg/hectare. Despite this, production is estimated to reach 200,000-225,000 tonnes, but there are rumours that the crop is much higher and better quality than last year, given acreage increased by 10-20% compared to last year. There has been less heat and more rain, so weather conditions have been favourable.

Nigeria is responsible for 10% of the global sesame seeds market. This year, production is estimated to be around 300,000 tonnes, exceeding the previous year.

Concluding Thoughts

- Chinese sesame consumption continues to grow alongside the middle-class population.

- However, conflict and macroeconomic issues are likely to cause headwinds for traditional suppliers.

- In Sudan, the biggest sesame producer globally, civil war has disrupted supply.

- Despite a large crop from India, production has stagnated, and exports have decline in line with the country’s wider food security policies.

- Pakistan has become a bigger producer but there may still be an overdependence on Nigeria, Tanzania and Mozambique’s crops for international exports.

- With higher demand and major supply issues in the pipeline, future sesame crops are likely to be smaller, pushing prices higher.