Insight Focus

- Putin’s annexations in Ukraine creates further uncertainty.

- Economic pressures see record currency levels.

- Supply and logistics remain key unknowns.

Introduction

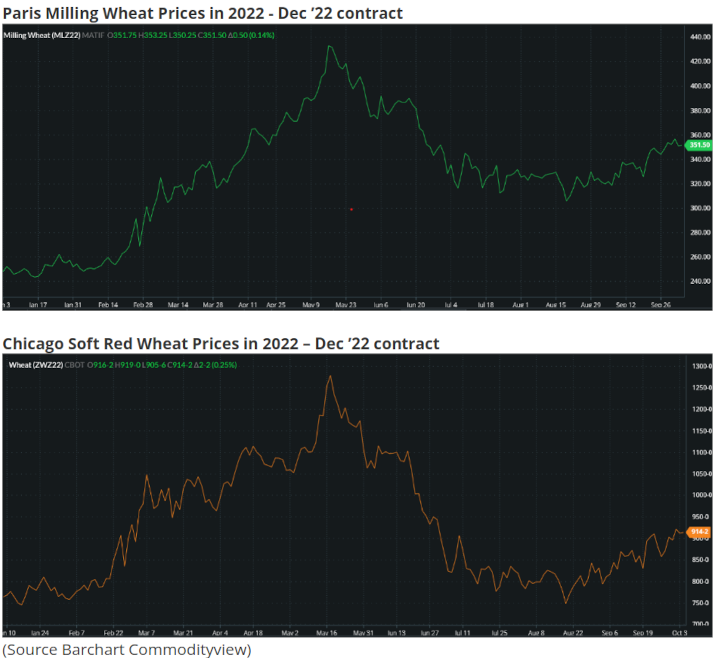

The extraordinary year of 2022 continues, as market influences around the World persist to create the uncertainty driving daunting price volatility. As seen in the charts below.

Wheat markets have seen impressive price increases since the short-term lows in mid-August, but assessing the strength of this trend going forwards reveals significant and conflicting fundamentals.

The Market Uncertainties

The main news driving wheat markets at this time of year is usually the difficult question of defining supply and demand for the coming months.

In 2022 we have the added and huge impact of Russia’s war in Ukraine with its associated repercussions.

War and Logistics

As Russia, the World’s largest wheat exporter wages war in neighbouring Ukraine; another major exporter in a normal year, we have seen the turmoil created for Black Sea exports over many months.

The UN and Turkey brokered deal to facilitate exports from Ukrainian ports in July has been a relative success to date.

However, Russia’s President Putin announced the annexation of 4 regions within Ukraine last week. With the Ukrainian military continuing to liberate areas within these regions, concerns turn to whether President Putin would jeopardise the continuation of these shipments.

The impact of any disruption would no doubt support prices.

In contrast, within the last couple of weeks, Russian consultancy SovEcon has further increased their forecast for the country’s wheat harvest to 100 million metric tonnes (mmt). A huge increase on the USDA’s estimate for last year’s harvest of 75mmt.

In the event that this huge crop finds its way through the Black Sea to the World’s major importers over coming months, we could see a dampening of prices.

Global economics

News outlets report rising fuel and energy prices, coupled with increased interest rates and inflation.

As finances get stretched governments attempt to calm their populations.

Recent weeks have seen unprecedented moves within currency markets, with the strength of the US dollar rising to record levels versus the likes of the GB Pound and Euro.

With the US Dollar dominating Global wheat transactions it is no surprise to see markets traded in weaker currencies seeing prices rise further in comparison.

High living costs coupled with high wheat prices, lead consumers to reassess their needs. The potential result being a drop in wheat demand, in time pressuring prices.

Supply and Demand

At the end of last month, the International Grains Council (IGC) increased their 2022 Global wheat production forecast from 778mmt to 792mmt.

An encouraging prediction by the IGC which may help to reduce supply concern over the coming months.

With prices currently at high levels, it is likely that Northern Hemisphere wheat plantings over the coming weeks will be large. This is nonetheless dependent upon favourable weather conditions, which have been far from predictable in 2022.

Conclusions

The next moves by Russia’s President Putin will likely steer the market up or down.

More uncertainty surrounding the war in Ukraine and Black Sea exports or increased Global political instability will support prices.

Any prospects for less human suffering in Ukraine and more political engagement would help alleviate concerns and offer pressure to prices.

Economic woes are main headlines, the more prolonged they are, the more likely that wheat demand will ultimately suffer helping the market Bears.

Weather permitting, the prospect of larger Northern Hemisphere plantings could well be the catalyst for better supply in the longer term, dampening fears for higher values.

Unpredictable times, weather, war, economics, supply and demand. They all have a part to play as we hope for less suffering in the Ukraine, more political stability and calming of hearts, minds and markets.

We may in time return to more normal fundamentals.