Insight Focus

- War in Ukraine still raging and the Black Sea grain corridor due for renewal

- Optimism for wheat crops despite the weather

- Looking ahead to potential significant market change

Introduction

We have endured the most incredible year of exceptional market turmoil and volatility that any of us can remember.

There are signs that the recent news headlines could be propelling the wheat markets into an entirely different phase.

The Markets so far in 2023

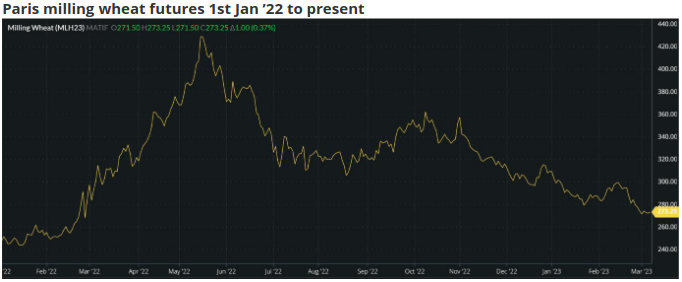

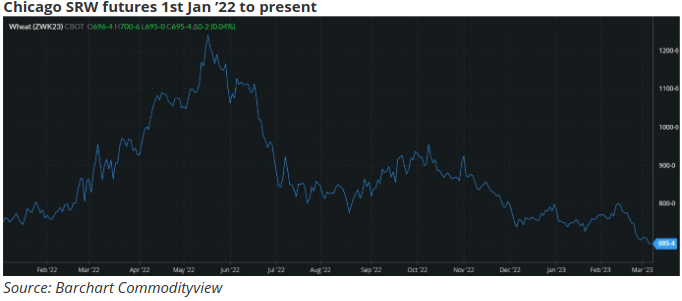

We have seen a gradual decline in prices since mid-October see charts below.

Wheat plantings for harvest 2023 have seen an increased number of acres in many countries, even if the weather since has been less helpful than was hoped.

An abundance of news looks to be driving the markets to a new phase.

The Black Sea grain corridor

Brokered by Turkey and the United Nations in July 2022 this initiative, signed by Ukraine and Russia, has allowed wheat and other grains to be shipped from Ukrainian Black Sea ports.

This has facilitated the imports for the world’s largest wheat buyers in North Africa.

Despite a number of issues, as we have previously discussed, the 120 day agreement was re-signed in November 2022.

With the next 120 day deadline fast approaching in 10 days, there is real optimism that an extension will be reached between Ukraine and Russia, laying some buyers’ fears to rest.

Crop estimates and weather

Weather has been troublesome for many wheat crops over the last few months.

Nonetheless, it looks as though Australia’s estimated record wheat crop has materialised with a yet larger forecast from Abares (Australian Bureau of Agricultural and Resource Economics and Sciences) at 39.2 million metric tonnes.

In the United States, larger winter wheat plantings have been overshadowed by the dry weather plaguing plants since being sown. However, there is encouraging news with wetter weather in the Southern Plains on the horizon.

In Europe, latest reports from France’s AgriMer suggest that the wheat crop is exiting the dry winter in encouraging shape, with 95% of the crop rated good/excellent.

With spring planting weeks ahead of schedule in areas of the Northern Hemisphere there is plenty to be positive about in anticipation of the 2023 harvests still many months away.

The USDA WASDE

(United States Department of Agriculture, World Agricultural Supply and Demand Estimates)

The monthly WASDE report to be published imminently is not expected to suggest big swings in global production or stock figures. This would help market stability in the coming days.

Conclusions

Wheat prices have seen a bearish tone in recent weeks.

Weather is not looking to be overly disruptive to crops in the near future.

Production forecasts are on the whole welcome news for wheat buyers.

The impact on prices from Russia’s war in Ukraine look limited, assuming the upcoming extension of the Black Sea grain corridor passes smoothly.

Perhaps, following unprecedented prices and volatility in 2022, the wheat markets may just be heading into a period of greater stability and calmness.

Hopes for market calm and stability seemed incredible only a few weeks ago. If it materialises, it will be welcomed by millions across the world.