Insight Focus

- Uncertainty surrounding exports from the world’s biggest sellers

- Fallout from bank collapses in Europe and the US

- Variable wheat crop reports and the latest WASDE numbers

Introduction

Assessing the reaction of wheat markets to the headline news of recent weeks may provoke some previously unlikely thoughts.

The Black Sea Grain Corridor Agreement and its extension has made it a focus over the past couple weeks.

Bank collapses on both sides of the Atlantic have brought back memories of the 2008 banking crisis.

A USDA monthly WASDE report and varied crop ratings from around the globe give us the more common fundamental news to ponder.

The Wheat Markets

The Big News Headlines

Russia’s War in Ukraine

As Russia’s war continues to rage, with unimaginable human suffering, battlefield gains appear to be minimal for either side at present. Thus, war on the ground is having no significant new impact on wheat headlines.

However, the renewal of the Black Sea Grain Corridor has seen a few complications over past weeks. Fortunately, as expected, an agreement has been reached between Ukraine and Russia, thanks to the brokering skills of Turkey and the United Nations.

Nonetheless, the previously agreed 120 day agreement is in doubt as Russia has suggested only a 60 day extension. This shorter period relates to Russia’s concerns with issues impacting their own agricultural exports.

Renewed Banking Concerns

News from the banking sector has been disturbing.

In the United States, both Silicon Valley Bank, the 16th largest lender in the US at the end of 2022 and Signature Bank, popular among crypto companies, have been shut down by the regulator.

Credit Suisse, Switzerland’s second biggest lender, has been rescued by its rival UBS, in a purchase hurried through by regulators in order to help shore up confidence in the Swiss banking sector, as fears mount about another banking crisis similar to the 2008 turmoil.

Crop Production

The USDA (United States Department of Agriculture) published its March monthly WASDE (World Agricultural Supply and Demand Estimates) on the 8th March.

Beginning stocks for 2022/23 were revised down to 271.45 million metric tonnes (mmt), from 276.70mmt in February. This was due to a reduction in China’s estimated stocks falling from 141.76mmt to 136.76mmt.

Global production for 2022/23 was increased to 788.94 mmt, up from 783.80mmt in February.

With the China stock figures, World ending stocks are forecast at 267.20mmt, down from 269.34mmt in February. Compounded by increased global exports and use.

Looking at wheat crops in the ground for the 2023 harvest there are mixed reports.

Poor crop ratings in the US with drought concerns remain.

While in Europe crops are generally looking good, with France suggesting 95% of the crop rated good/excellent.

Conclusions

The volatility and market records smashed in 2022 saw participants on edge with every story published.

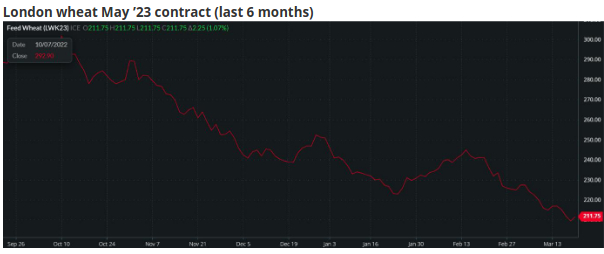

A steadily falling market over the last six months has been reassuring for many of the World’s buyers.

Looking at concerns reported in current news:

- Potentially devastating exports from the Black Sea and the World’s largest exporters.

- Add in a potential repeat of the Global banking system melt down of 2008.

- Falling end stock numbers from the USDA monthly WASDE report

- Compound unease with ongoing crop issues, such as drought in the US.

In past years, prior to Russia’s invasion of Ukraine, all of these headlines would have constituted major market news, with influence for the coming weeks.

However, on the contrary, we have seen a small bounce in prices over the last couple of weeks, with the bear trend reappearing as we write.

The signs are that the crazy and volatile markets of 2022 have calmed over the last few months.

A suggestion that wheat markets are adapting remarkably well and remain increasingly resilient to a World where significant, changing news stories are never far away.