Insight Focus

- Black Sea grain corridor negotiation uncertainty.

- The USDA WASDE May report numbers for 2023/24.

- Wheat market set for some volatile days ahead.

Introduction

Russia’s dissatisfaction with agricultural export shipments looks like coming to a head, with the Black Sea Grain Corridor Agreement expiring next week.

The 12th May looms for a host of numbers in the monthly USDA (United States Department of Agriculture) WASDE (World Agricultural Supply and Demand Estimates) report. It will be the first of their reports to publish forecasts for the 2023/24 marketing year.

The wheat market prices could certainly see some fireworks ahead if either of these two issues cause a storm.

The Wheat Markets

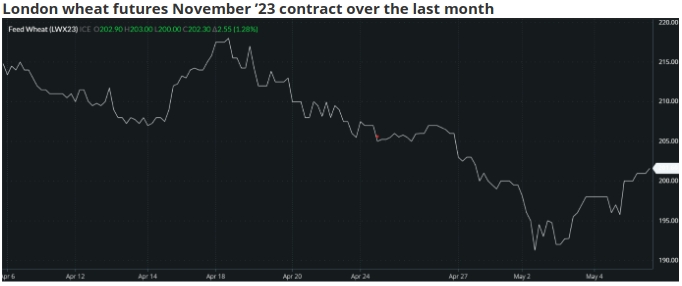

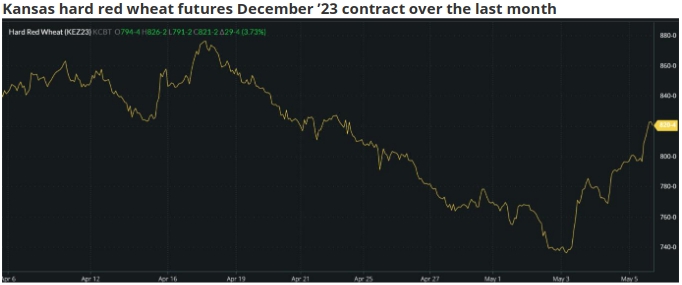

The last month has certainly seen a rollercoaster ride for the leading wheat markets.

The three charts below demonstrate the volatility with many factors playing their part.

Source: Barchart commodityview

This is the time of year when focus is normally firmly on the 2023 harvest ahead. With the Northern Hemisphere wheat harvest only weeks away, number crunching is in full swing and big news is never far away.

The headlines regarding the Black Sea Grain Corridor Agreement have added to the uncertainty driving recent volatility.

The Black Sea Grain Corridor Agreement

The efforts of Turkey and the United Nations to negotiate the agreement between Russia and Ukraine was an incredible achievement in July last year.

It was disrupted by an attack on the Crimean port of Sevastopol, home to the Russian Black Sea fleet, on Saturday 29th October 2022. Russia withdrew its participation with immediate effect. However, this only lasted a matter of 4 days before Russia agreed to continue with the agreement.

The 120-day accord was renewed later in November, despite the Russian protestations.

In March ’23 Russia agreed to an extension of only 60 days as opposed to the previous 120.

Russia has maintained its displeasure that their own agricultural exports continue to be hindered by the West’s sanctions.

There have been attempts to pacify Russia. We saw on Thursday last week, Turkey’s suggestion that their Ziraat Bank could act as an intermediary for Russian grain payments.

The Russian news agency, RIA, has announced that 4-way talks will take place in Istanbul on 10th-11th May to consider renewal of the agreement.

Nonetheless, Russia has firmly stated that unless their demands to ease barriers on Russian exports are addressed, there will be no extension beyond the current expiry on 18th May.

We believe there are many reasons as to why Russia, the world’s largest wheat exporter, needs to maintain the agreement, as outlined in our article on 2nd November 2022:

- Russia wants to maintain exports of circa 44mmt of wheat, through the Black Sea from their own record 2022 harvest.

- Many countries not condemning Russia’s invasion of Ukraine in the UN votes, are countries reliant on Russia for wheat to feed their people. President Putin will surely wish to keep them from rallying against him politically.

- A spike in wheat markets, as seen in 2022, would cause more global economic turmoil, which could further damage Putin’s position with international political allies, such as China.

The USDA WASDE

The 12th May will see a plethora of estimates from the USDA looking forward to the coming year in the world of wheat and agricultural commodities.

Weather is mixed around the world.

Too dry in some hard red wheat areas of the US, with crop ratings at a disappointing 29% good to excellent.

Rain in the spring wheat regions, slowing planting progress, with 24% planted, vs the 5yr average of 38%.

European weather, on the other hand, is much better, with the French wheat ratings last week at 93% good to excellent, vs 89% last year.

There is much to consider as we look ahead for wheat prospects, with a real possibility that Friday’s report could spring some surprises.

Conclusions

There is much focus on Russia and their participation in the Black Sea Grain Corridor Agreement, which many hope will be renewed ahead of next week’s expiry.

Ukraine has stated that Russia has already halted the agreement by refusing to register new incoming vessels.

It would seem a high-risk strategy by Russia to block the agreement for any prolonged period.

However, there could be significant benefit to Russia by holding it up to gain political leverage over sanctions from the West.

The May USDA WASDE report will no doubt add a few sparks to the market. The final figures released will determine whether we see calm or fireworks.

Two major issues for the world of wheat to deal with over the coming days.

A calming of nerves or an explosion of price volatility?

We will find an answer over the next week!