Insight Focus

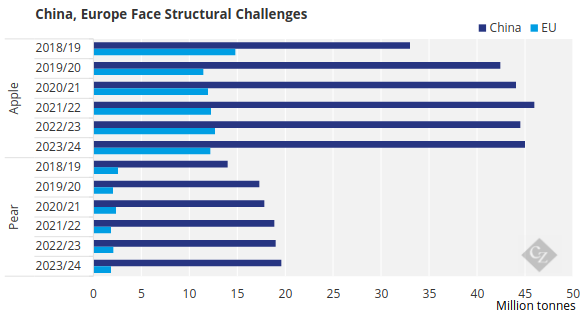

- China is the world’s largest apple and pear producer by far.

- But domestic food security policies could jeopardise the future of orchards.

- Could the Southern Hemisphere fill in some of the production gaps?

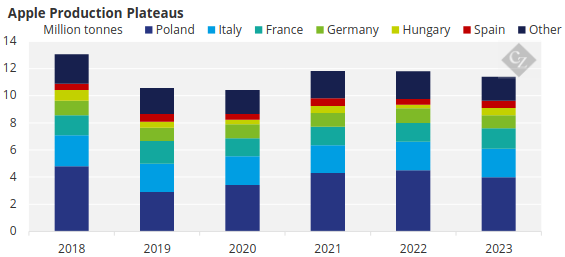

Companies of all sizes around the world, from multinationals down to local grocers, are concerned about supply chain security. China is the world’s biggest producer of apples and pears, but government policies have disincentivised growth.

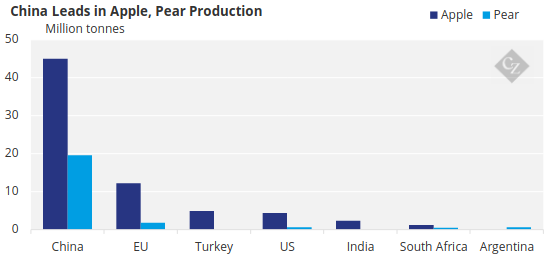

Additionally, other major Northern Hemisphere suppliers such as Italy and Spain have faced production losses due to adverse weather, diseases and low yields.

Source: USDA

Can global apple and pear supply remain stable amid this backdrop?

China’s Orchards Clash with Crops

Both apples and pears are native to Asia, so it is no surprise that China remains the world’s largest producer. In fact, China produces about 55% of apples globally and 78% of the world’s pears.

Source: USDA

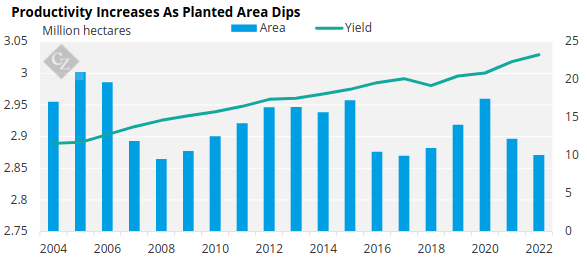

However, despite being the world’s largest apple and pear producer, China is allocating less land to orchards and more to staple crops. It is well known that the Chinese government has placed a massive emphasis on food security to feed its growing population, and as a result, has imposed very strict policies regarding farmland use.

According to a USDA analysis on stone fruit production in China, orchards that produce fruit on viable farmland are being gradually phased out in return for compensation for farmers. The government wants to instead promote the growth of wheat, rice, corn, cotton, oilseeds, sugar, vegetables and forages on this land.

The government has stopped short of removing orchards that are already in full production. The USDA report also states that many of the fruit orchards in western China are located on “orchard land” or “forest land,” which is not appropriate for crop cultivation. While there will likely be a reduction in orchard on potential farmland, there could also be a move towards hillier areas in western China from current locations in central and north China.

Source: NSBC

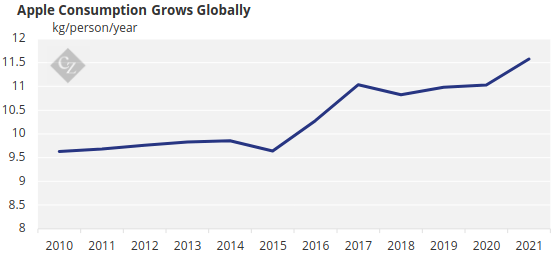

As the world’s major producer of apples and pears, any disruption to Chinese orchards is likely to have an impact on global supply chains, especially since apple and pear demand has remained stable.

Source: FAOSTAT

And around 20% of China’s apple crop is currently represented by high-density plantings featuring dwarf trees. These high density plantings have been found to erode soil quality and exacerbate water shortages, particularly in very high production areas such as the Loess Plateau.

Can Southern Hemisphere Pick Up Slack?

Considering Chinese apple production is now plateauing after decades of growth and EU production is dropping, apple processors around the globe have start to consider other producing regions and are looking to the Southern Hemisphere.

Source: USDA

In general, the Southern Hemisphere’s crop is expected to grow over 1% year over year to bring it up to 4.8 million tonnes. South Africa leads the region with 1.4 million tonnes of apple production, followed by Brazil at 1.1 million tonnes. Production in Chile is expected to be close to 1 million tonnes, but this represents an 8.3% reduction from last year.

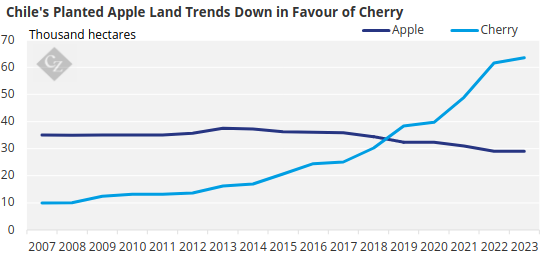

In a very similar situation as China, planted apple area has declined this year in Chile. But unlike in China, this is a consequence of the low apple returns to farmers, which has forced them to change their crop to other fruits with higher profitability such as cherries or apricot.

Source: Chilean Office of Agrarian Research and Policies

The situation for pears worldwide is not very different from apples. However, although pears face the same structural challenges in China and the EU, South Hemisphere projections do not look as good as for apple.

After China and the EU, Argentina is the third largest pear producer in the world. China and Argentina harvest their pears at different times of the year. If strategically managed, this can guarantee a fresh product and ensure security of supply.

Source: USDA

But Argentina is expected to produce 6% less than last year, with 614,000 tonnes in 2024/25. Despite the good crop, weather conditions affected the flowering and delayed the harvesting to March. There is also a smaller planted area due to urbanization, shortage of growers and the continued higher production costs resulting in low revenue from the fruit.

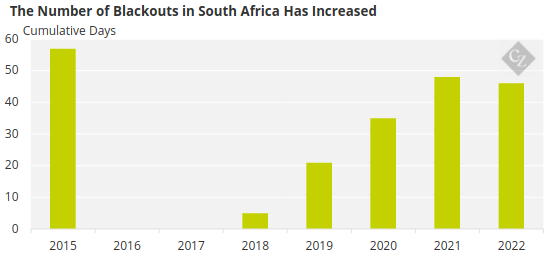

Meanwhile, South Africa continues investing in the development of orchards and reliability of power and water resources, showing slow but steady production growth over the last 10 years. This has represented a pear orchard expansion of 1% per year. This year is expected to be the same and combined with better weather conditions than last year, there should be a growth of 3.4%, meaning a total production of 567,334 tonnes.

However, South Africa continues to struggle with challenges related to national utility company Eskom, which has experienced increasing numbers of blackouts, impacting the agricultural and industrial sectors.

Source: Farmers Weekly

Concluding Thoughts

In conclusion, given the challenges Northern Hemisphere countries have experienced in recent years, there is an opportunity for those in the Southern Hemisphere to begin investing in crops such as apples and pears.

Despite challenges, this year’s apple juice concentrate production is forecasted to be very similar to that of last year, which equates to a total of 30,000 tonnes of processed product.

Overall, global pear production is forecasted to raise to 24.9 million tonnes, mostly due to China – although there are risks involved with this high concentration. While China offset reductions in EU pear production, countries in the Southern Hemisphere expect to experience a 2.3% decrease, which translates to a total of 1.47 million tonnes of fresh pear.