Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

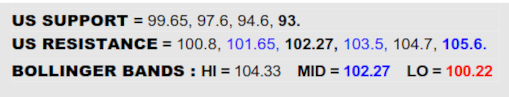

ICE BRENT CRUDE OIL SPOT

The engine for a B-Berg downtrend escape, Brent finally blew the hatch at 78.5 to forge the past two months into a base and likely springboard on towards 86 where a far larger inverse H&S could be in the offing to create fuel to triple digits. Only a stumble that veered back through the 78’s to crack the mid band (76.53) would question these improvements.

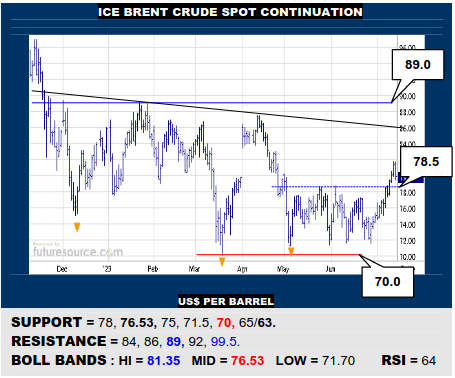

NYMEX NATURAL GAS 2ND CONTINUATION

Hope for Nat Gas sparked by a Jun rally quickly fizzled as Jly arrived and a tiny H&S emerged with the loss of the mid band. This currently poses a threat to nearby support at 2.47, its demise reassuring the tiny top and opening a door down to the 2.20’s again. Must hold 2.47 and react over the 2.70 neckline to instead perk things up again.

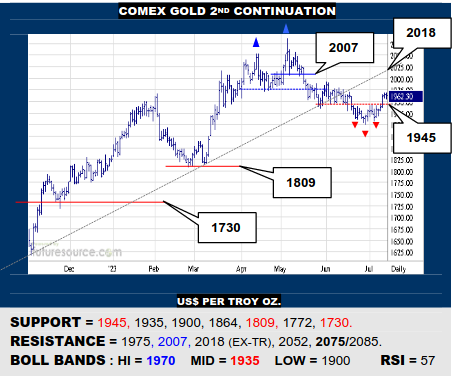

COMEX GOLD 2ND CONTINUATION

Clearing 1945 to depart a small inverse H&S as the Dollar took a dive puts Gold on a more offensive footing with murmurs of a bull flag taking shape after the base. Thus looking towards the 2007 to ex-uptrend (2018) realm for the moment, only a Dollar rebound over 100.8 and a swat back below the 1940’s here diluting this more optimistic scene.

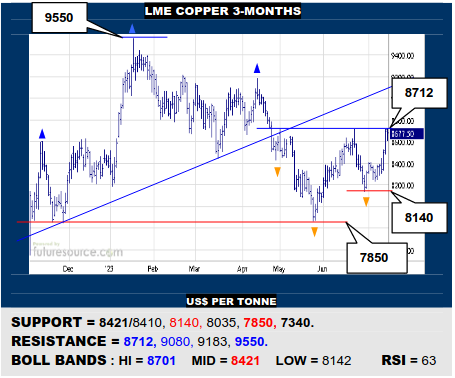

LME COPPER 3-MONTHS

Gathered up by the lower Bollinger late in Jun, Copper has unleashed a new rally as the Dollar ails and is attacking the preceding 8712 hurdle from last month. Busting beyond would rig a ragged but promising new inverse H&S base that would point on up to the early ’23 peak at 9550. If blunted at 8712 though, watch the low 8400’s for vital underpinning.

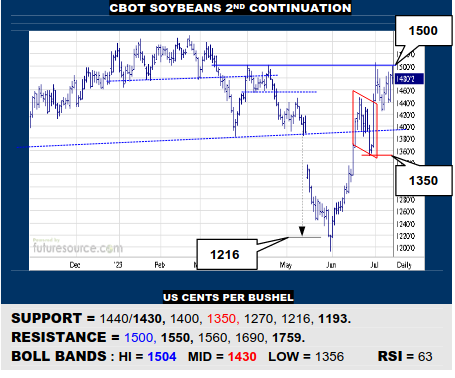

CBOT SOYBEANS 2ND CONTINUATION

An early Jly dip was still swept up safely clear of the underlying mid band (1430) to keep Beans focused on the 1500 frontier. Bust through and the market could claim another bull flag escape and the broader path into the 1700’s would begin to beckon. Only continued denials at 1500 and reeling back under the mid band would upend this effort.

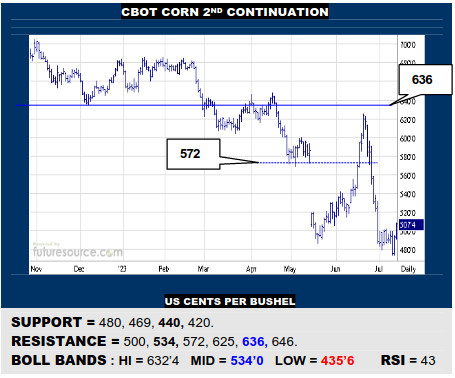

CBOT CORN 2ND CONTINUATION

A glimpse under 480 was grabbed back and in lunging into the 500’s Corn makes a case for a false breakdown. If it can just hold the 500’s early next week, it would duly take aim at the mid band (534) as a portal on to the 600’s again. Need the 500’s footing proven though whereas any second gouge below 480 could press on down to 440-420.

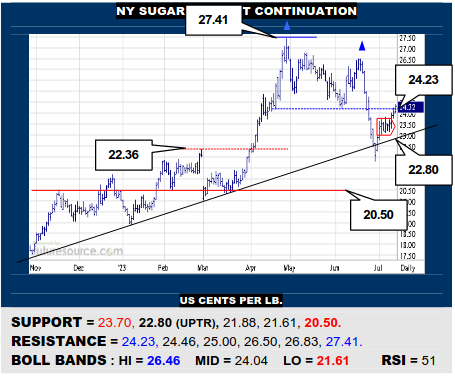

NY SUGAR #11 SPOT CONTINUATION

Swiftly patching its uptrend disruption once the Jly contract had expired, Sugar is laying siege to the prior double top, having just pushed by its mid band. Hold the 24’s and surge clear of 24.23 and it would be back on track to the 26’s/27’s then but meantime do just keep watch on 23.70 as a pivot to signal a stumble where it could all fall apart again.

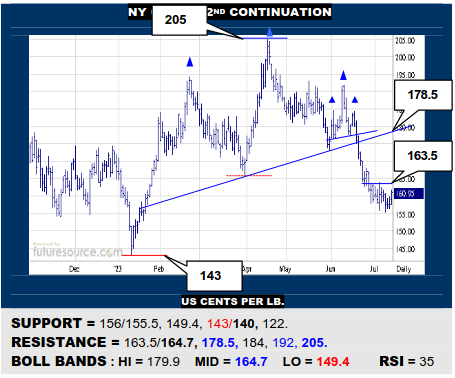

NY COFFEE 2ND CONTINUATION

Cautiously applying the brake in the past few weeks, Coffee now needs to pop the 163.5 initial resistance just as the mid band is poised to arrive (164.7) to really carve the turn, whereupon an interim correction back up towards the H&S neckline (178.5) could be seen. Alas, if kept hemmed in under 163.5, keep minding 156/155.5 as a tripwire on down to 140.

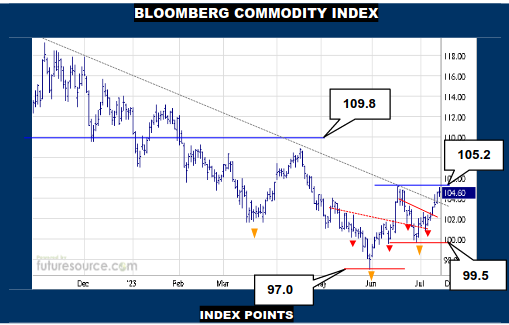

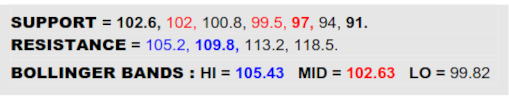

BLOOMBERG COMMODITY INDEX

Finally, after a whole Q2 of thrust and parry dicing, the two macro indices appear to be making more definitive commitments to a path. For the B-Berg this has left a couple of modest inverse H&S bases but, in now escaping the broader downtrend(s), defeat of 105.2 would merge the lions’ share of ’23 into a much bigger version of such a pattern and dial in the crosshairs on the final 109.8 escape hatch to a full blown turnaround. Whether exit into the 110’s would then start to affect those inflationary stats and thus renew ‘Fed fear’ we must just wait and see but for now only swerving back through the mid band (102.6) and below 102 would undercut the early Q3 achievements.

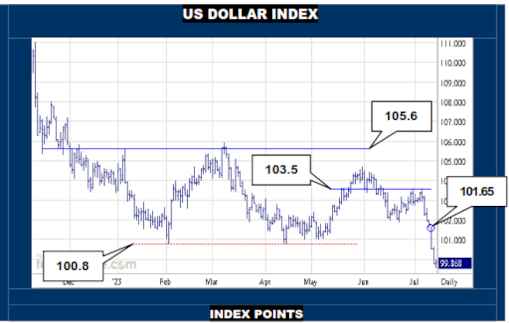

US DOLLAR INDEX

Though spending the first half of the year attempting to score a turn back upwards, the cooler inflation stats and thus calmer Fed tone finally pulled out the rug in Jly and the Dollar has tumbled to new depths, departing triple digits. One would initially view the tiny 101.60’s gap as a ‘breakdown’ gap in this process but there is a little proving to do in that respect because, if instead also just considering the possibility of it being a lesser ‘measuring’ gap, then it just hit its mark at 99.65. So while further pressure next week would persuade of the wholehearted breakdown scenario and take aim at 94/93, if the mid 99’s held repeatedly, doubts could be sown in the event of a reflex back up across 100.8.