Insight Focus

- Non-Fonterra processors steadily eke out market share gains.

- Sustained Chinese domestic milk production growth should be monitored.

- Fonterra’s firework forecast adjustments and market dynamics affect NZ dairy landscape.

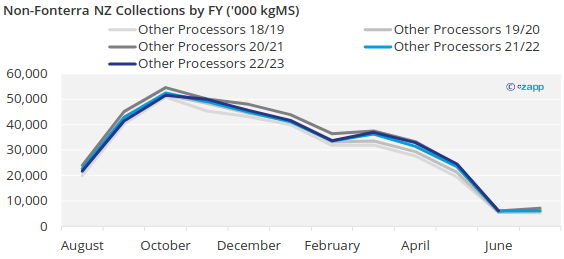

New Zealand Milk Collections:

- The latest milk collection figures for the month of June have been reported by all dairy processors. We are now in the relatively boring point of the NZ milking season where most herds are dried off as farmers get cows back into condition ahead of the coming season.

- As previously mentioned, the non-Fonterra sector has done very well in attracting “winter milk” so their market share for the month is up at a record 29.3% share (FYTD sitting at 20.9%).

- At a national level the YoY collections were slightly down (-0.42%) and the FYTD collections are stable at (+0.28%). Essentially, we have just seen the non-Fonterra group win relatively more of the valuable “winter milk” this FY.

- My models predict that the non-Fonterra group will continue to win an extra 0.1% market share on average every three months.

- All eyes are on the coming NZ peak and how the various processors are set up for this. The whole country is reporting good soil moisture levels with abnormally moist soil in the central and lower South Island. Synlait’s Dunsandel, Fonterra’s Darfield/Edendale/Clandeboye and OCD’s Awarua plants may stand to do particularly well from this which may slightly tilt the coming peak production toward more WMP.

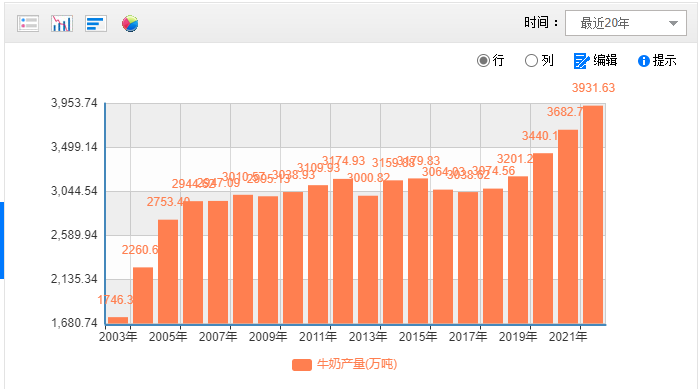

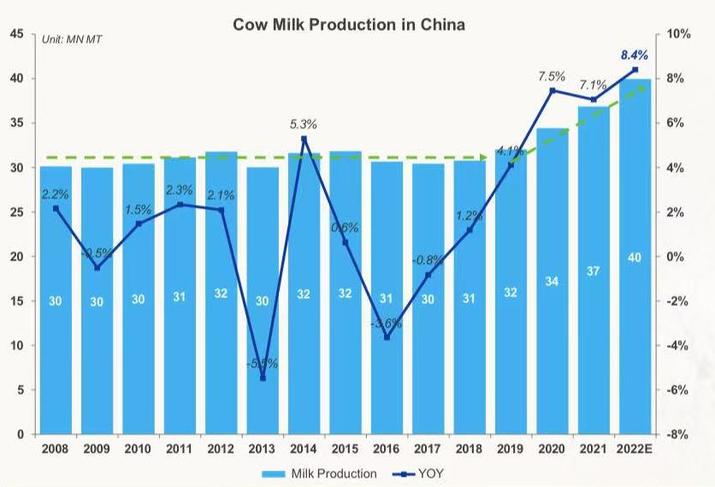

Some Comments on China:

- Since 2019 China’s dairy industry has been the target of a strategic revitalization, significant results are now being seen with each new phase.

- In 2022, China’s milk production reached 40.27 million MT. This was up 6.6% YoY on the prior year and the first time China has produced over 40m MT. This milk production has China now ranked fourth largest in the world.

- It is important to note that the majority of local production is consumed within China and although growth is significant, so too are the imports required to supplement the demand growth in this market. However, if this growth trend persists then we are likely to see exporters needing to pivot as local production steadily displaces the need for products such as WMP.

- The average Chinese dairy cow now produces 9.2 MT of milk. Incredibly, China has managed to double the average yield from their herd over the past 15 years, it is now twice as much as in 2008.

Chinese Milk Production in past 20 years (unit: 10kMT)

Source: NBSC

Source: National Bureau of Statistics

The fireworks in NZ:

- While we may be in the boring part of the milking season there have been several big sound bites to hit the NZ dairy market in the past week.

- Fonterra downgraded their milk price forecast to $7 per kgMS. This sharp drop seems not to have been expected by the market however the points I have made above are likely to have been on decision makers minds. This reduction will see most NZ dairy farmers expecting to make a loss in the coming year. An announcement of this magnitude at this early stage may impact supplementary feed buying decisions so could slow down some of the coming tidal wave of milk from NZ, but is unlikely to be material.

- Fonterra then added 20,000 MT of WMP to the 12-month forecast GDT volumes which is likely to weigh on price, the first 1,000 MT of this coming on the next event which is unusual. This follows a series of prior volume additions already.

- The Algerian Government milk powder tender run by ONIL was over 80% won by NZ based suppliers at levels which were arguably at a discount to GDT pricing at the time (depending on who’s freight you use). This print then predicated a sharp decline on the recent GDT for WMP this week.