Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

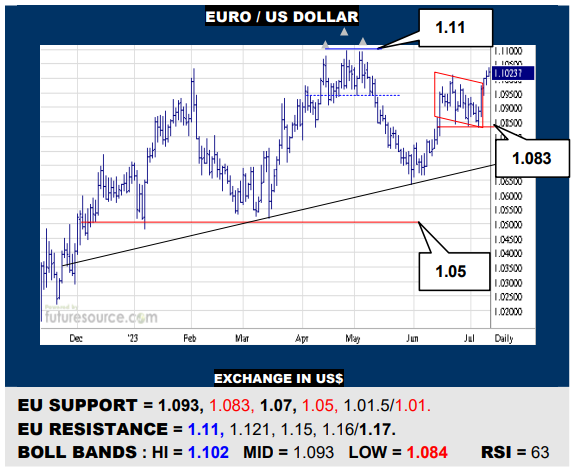

EURO / US DOLLAR

The EU has made a new effort from the 1.083 ledge to poke at the 1.10’s and suggest a flag getaway. Must swiftly convert this into defeat of 1.11 to shift up another gear and reach a 1.121 flag projection with an eye towards 1.17. If foiled below 1.11 and reversed through the mid band (1.093), watch 1.083 as the broad H&S top risk returned.

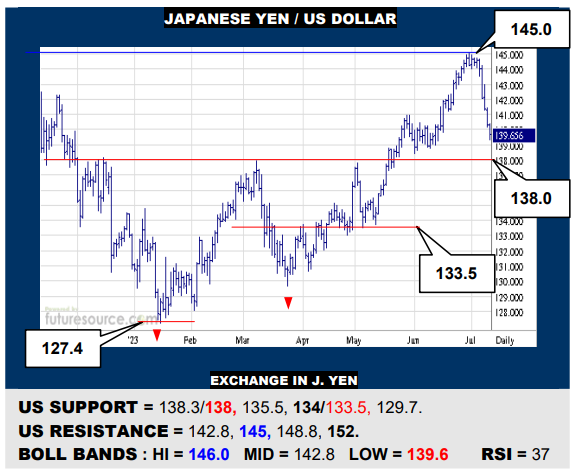

JAPANESE YEN / US DOLLAR

The US was quick to flinch at the 145 resistance and has ripped back through the mid band to reach the lower Bollinger. Must cater for jabs into the 138’s but the 138 base border looks the best chance to rein in this dive and try to resume north. If 138 also cracked, look for a further step back to a Fib retracement (134) and test of the next 133.5 rung.

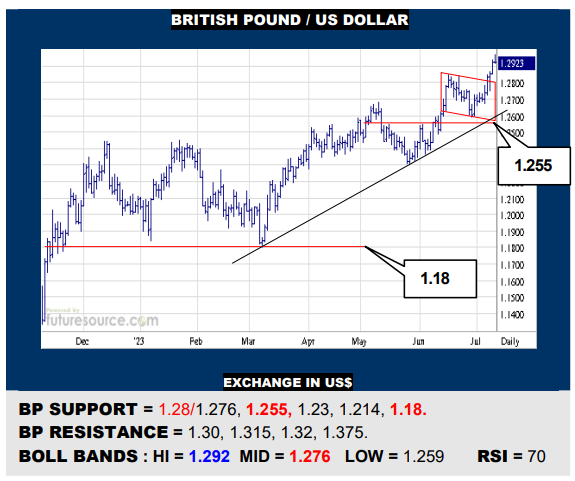

BRITISH POUND / US DOLLAR

In holding clear of 1.255 and stretching to new mid term highs the BP appears to have exited a flag that proposes a next goal of 1.315. Can’t underestimate the 1.30 figure meantime though and, if obstructed there, watch the 1.28 to mid band (1.276) niche as important bracing to prevent a sharper swerve back to test 1.255 after all.

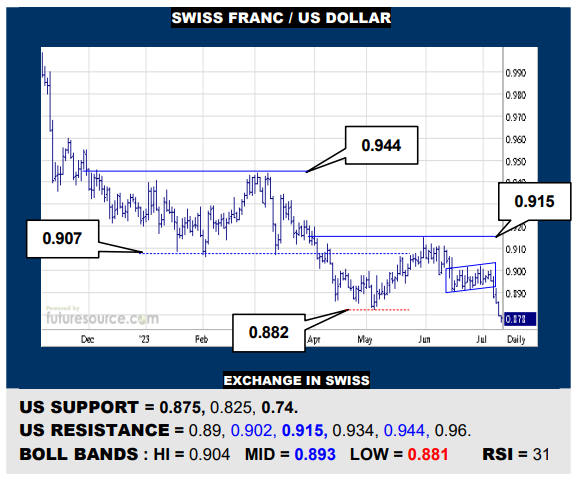

SWISS FRANC / US DOLLAR

The US falling from the 0.89’s marked a sort of bear flag exit but the stunted flagpole means it has already met its mark at 0.877 just clear of the early ’21 low at 0.875. This looks a vital restraint to prevent the past decade evolving into a massive top with nothing to then apply the brake until 0.74. Must react back over 0.89 to regain a little poise.

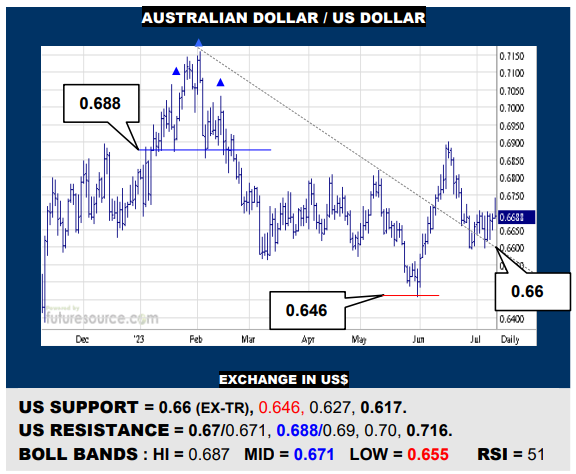

AUSTRALIAN DOLLAR / US DOLLAR

The AD has held the fort near its ex-downtrend (0.66) but a lunge out over initial 0.67 resistance has provisionally stumbled and must be better defined to claim a small new base area from which to try for the 0.688 H&S rim once again. Meanwhile still minding 0.66 closely as a break below could elicit a sharp new drop through 0.646.

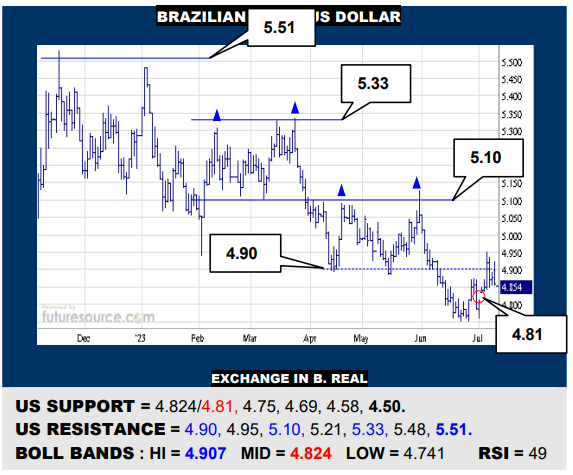

BRAZILIAN REAL / US DOLLAR

The US has rebounded to jab at the Q2 dual top above 4.90 but hasn’t yet made a convincing dent. Must attain and sustain 4.90 levels to persuade of a more reliable turn therefore that would present scope on up to 5.10 next. Minding 4.81 meantime as a tripwire to deflate the swell and threaten resumed losses through 4.75 into the 4.50’s.

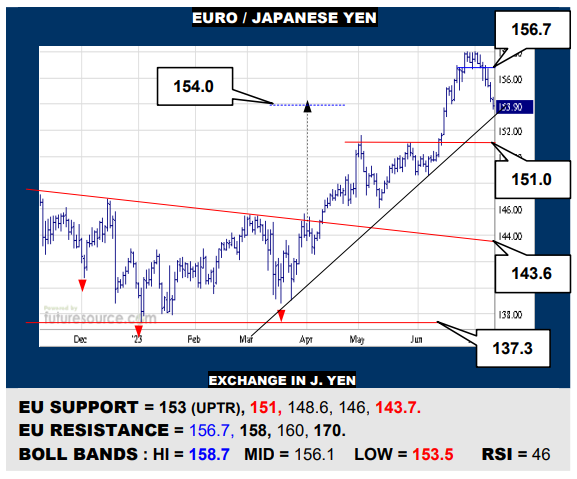

EURO / JAPANESE YEN

The EU has swerved back from a small 156.7+ top and is nearing a test of the interim uptrend (153). If able to gather up aboard this trend, a new push for 158 could yet follow, still eying the 170 millennium high. Be increasingly wary if the uptrend broke though, just the 151 ledge then left to prevent a far sharper setback to the 143’s base rim.

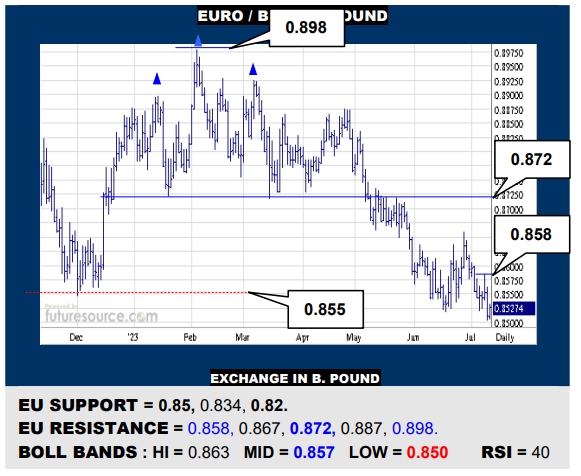

EURO / BRITISH POUND

The lower Bollinger band is helping to initially temper the EU’s slide through the 0.855 support but this restraint cannot be fully trusted as that band is itself dropping. Must produce a feistier reflex back over 0.858 to make any sort of false breakdown claim then while anything less would still leave the door ajar on towards the 0.82 precipice.