Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

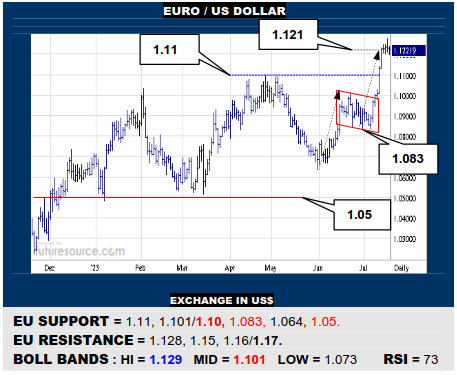

EURO / US DOLLAR

After a flag escape into the 1.10’s, the EU quickly followed up with a getaway across 1.11 to attain a 1.121 projection, where it has eased off the throttle temporarily. Just consolidating in the 1.12’s could build another flag so mind 1.128 as a trigger on into the 1.16’s. Only reeling back through 1.10 would otherwise seriously upend this picture.

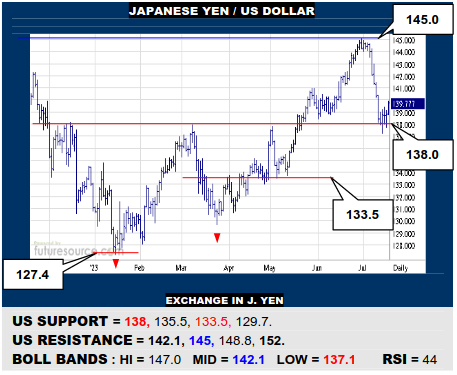

JAPANESE YEN / US DOLLAR

Despite a quick jab inside, the sub-138 base has managed to take the sting out of the nosedive back from 145. Even so, stay cautious of the breather currently taking place as just idling in the upper 130’s could create a bear flag risk for a true break of 138 and drop to 133.5. The US must react over the mid band (142) to show tangible new verve.

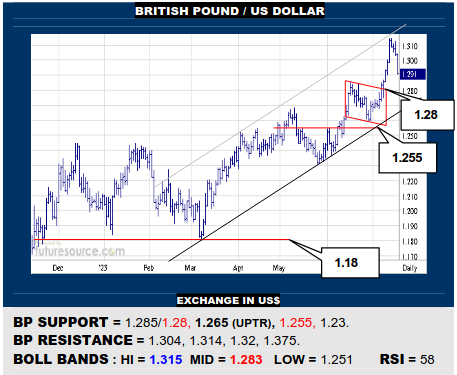

BRITISH POUND / US DOLLAR

The BP came up just a whisker shy of its 1.315 flag projection before turning on its heels and falling back quite swiftly towards the flag from whence it came. This should offer better support in the low 1.28’s to spur another try into the 1.30’s. However, if 1.28 gave way, beware more false breakout whiplash that could endanger the uptrend (1.265).

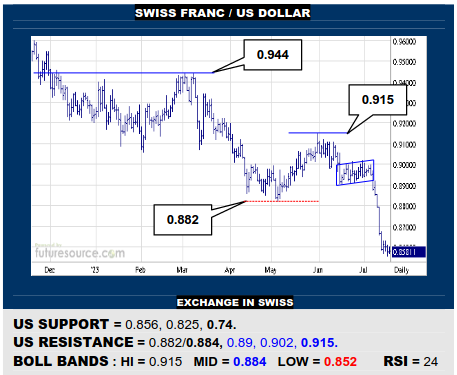

SWISS FRANC / US DOLLAR

The US has crashed through long term 0.875 support only breached once in the past decade. This is inferring a colossal top and little or nothing to stem the tide until 0.74. An ominously frail predicament then and it would take a reflex back over 0.882 to score a remarkable save that would in turn signal a false breakdown to steady the boat.

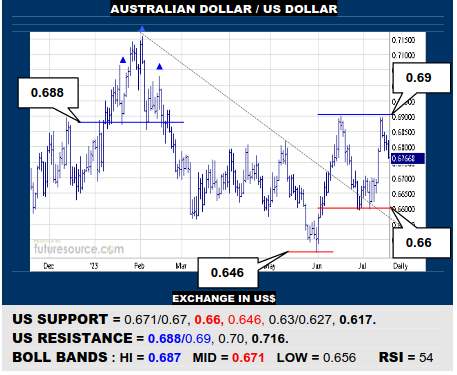

AUSTRALIAN DOLLAR / US DOLLAR

Another stab at the Q1 H&S over 0.688 has been smothered but, if the AD can make a catch in the 0.67’s aboard the mid band (0.671), it could still have a third shot at the prize. Be far more wary however if swept back below 0.67, the warning light for a possible dual top then illuminating where breaking 0.66 would measure on down to 0.63.

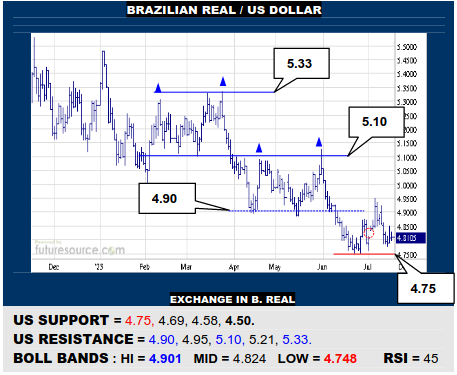

BRAZILIAN REAL / US DOLLAR

Soon rebuked from the 4.90’s, the US has filled a low 4.80’s gap and is just attempting a little consolidation. Wary of the bear flag prospects for this action under the circumstance so do still watch 4.75 support as a tripwire on down towards the monthly uptrend at 4.50. Must pop 4.95 to make a more reliable impression by installing a double bottom.

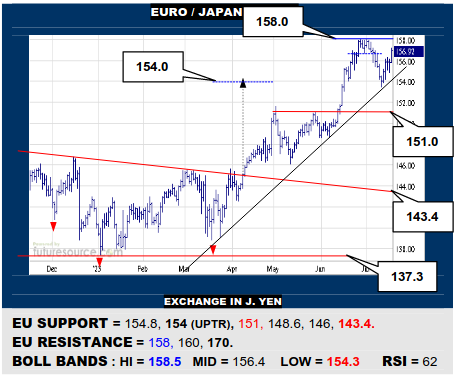

EURO / JAPANESE YEN

The EU’s rebuke from 158 was pulled together by the arriving uptrend (154) and it is zeroing in on those recent highs again. If able to swiftly bust beyond, the advance would be thoroughly reassured and may yet have a shot at the 170 millennium high. Only resumed stumbles at 158 would give cause to mull a toppier result and a risk to the trend.

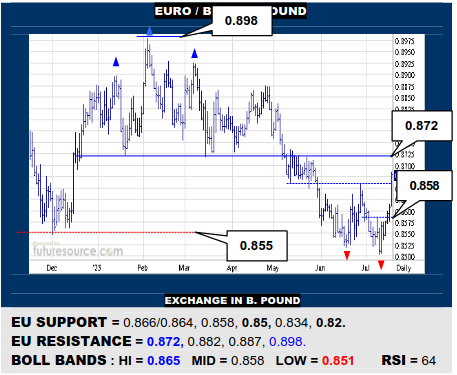

EURO / BRITISH POUND

Lower Bollinger defence maintained the 0.85’s and the EU pivoted back over 0.858 to stir new zest and hustle on across 0.867 to build a mid-year double bottom that creates competition for the prior H&S over 0.872. Expect some nip and tuck around 0.87 accordingly but if later able to pierce 0.872, the base projects on up to 0.882.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.