Insight Focus

- The 2020s have already made a remarkable impact on global food chains.

- Changing consumption habits, re-examining of supply and an increase in protectionism have been key themes.

- These have been mainly driven by Covid, the war in Ukraine and food security concerns.

We are just three years into the 2020s and already the global food system has undergone extensive transformation. Inflation, shortages and conflicts have all impacted the way we eat and source food. We examined just a few of the major trends that have emerged over the early 2020s.

Quality, Convenience Over Price

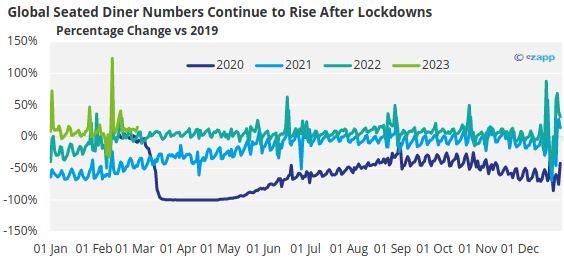

During the early months of the Covid-19 pandemic, there was much less out of home food consumption due to widescale lockdowns. Of course, this led to pent up demand that remains strong today.

Source: OpenTable

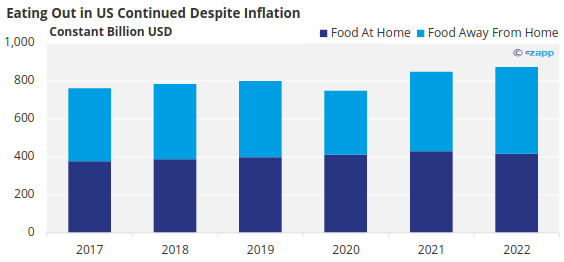

The desire to “treat oneself” is persisting despite a new inflationary pressure. In the US, out of home food consumption continued to increase in 2022.

Source: USDA

… But a Reversal is Beginning

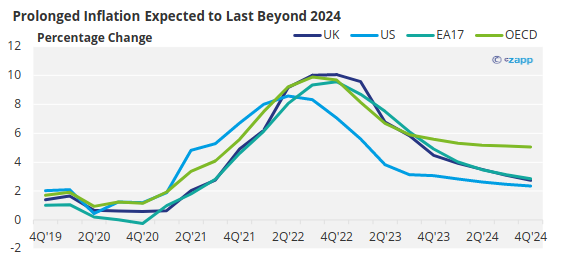

As the world expected, inflation began to climb in 2021 and many indicators are pointing to a recession. This is set to impact consumer spending habits.

Source: OECD

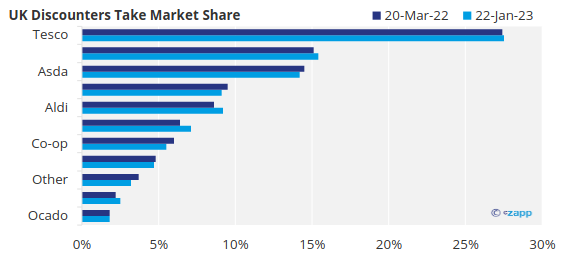

Already, the increase in grocery costs has seen discounters take a greater market share.

Source: Kantar World Panel

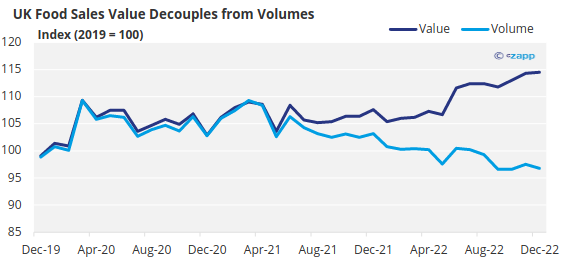

Even though more people are visiting discounters, prices are still rising. As a result, volumes of food purchased are declining while values continue to rise. In short, people are paying more money for less food.

Source: ONS

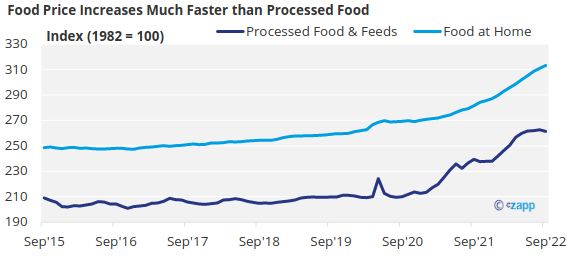

Not only this, but the rising costs of all food far outpaced the price rise of processed food, meaning processed food is becoming the most affordable option.

Source: St Louis Fed, St Louis Fed

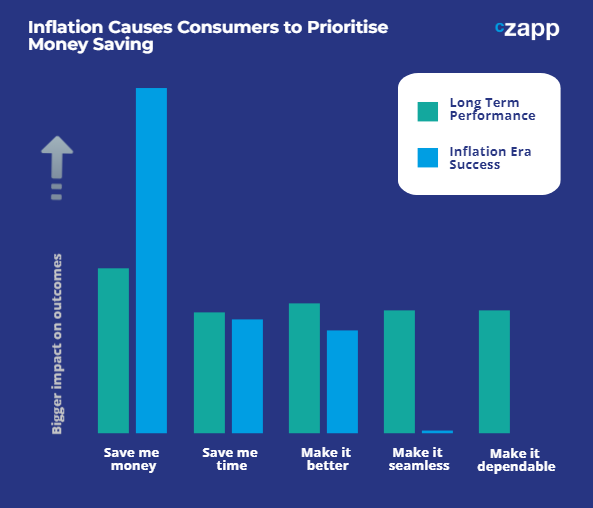

And consumers are more likely to prioritize low-cost options during an inflationary period.

Source: DunnHumby

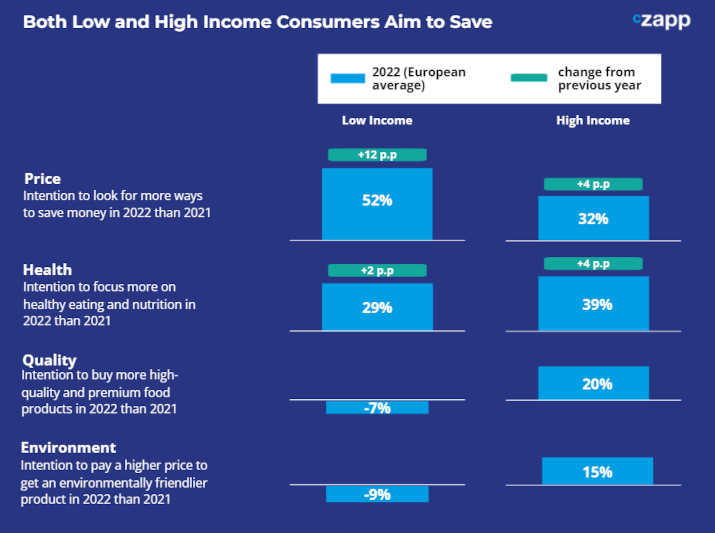

This is true across all socioeconomic sectors.

Note: European average = share of consumers who want to do more of activity minus share of consumers who want to do less of activity in 2022 vs 2021; thus negative numbers imply that consumers want to reduce their grocery shopping in these categories.

Source: McKinsey State of Grocery 2022

Find out more about recession-related consumer behaviour here.

Shortages Became Common

At the height of the pandemic, supply chains became collateral damage. Covid restrictions, labour shortages and an increased focus on protectionism meant several shortages were seen.

In Southeast Asia and Africa for instance, large food retailers such as McDonalds and KFC experienced potato shortages, forcing them to ration French fry sales.

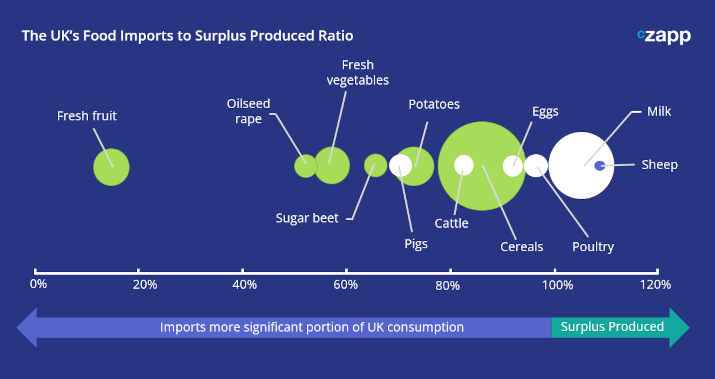

For the UK in particular, which is simultaneously facing Brexit-related logistics issues, the problems have come home to roost this spring. The UK’s food production to supply ratio is 74%, but it imports a significant amount of fresh fruits and vegetables.

Source: DEFRA

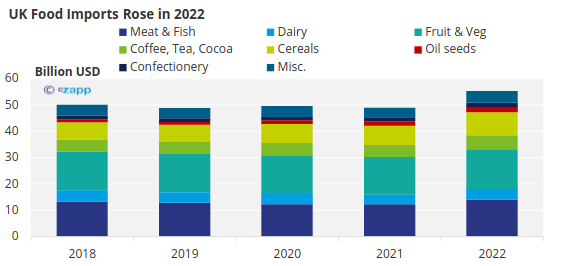

The UK’s food imports have increased significantly in 2022 but shortages on store shelves have become more and more common.

Source: UN Comtrade

Supply Chains Were Re-Examined

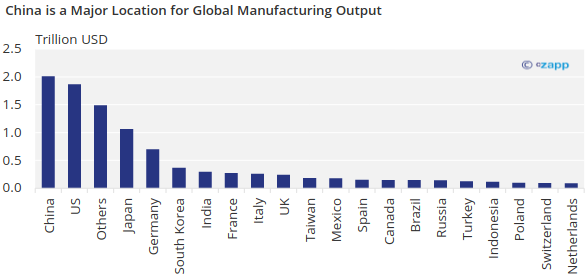

China is the epicentre of global manufacturing. About 20% of the world’s manufacturing output is produced in the country.

Source: Brookings Institute

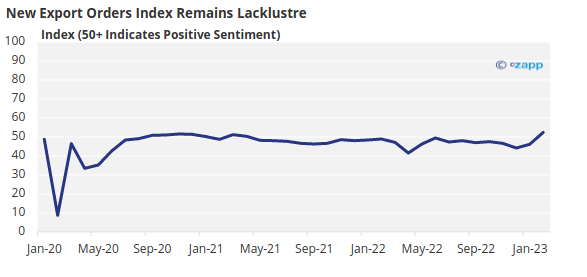

But China has imposed one of the strictest Covid policies in the world since 2020 and as a result, its position as a global manufacturing hub has become compromised.

Source: National Bureau of Statistics of China

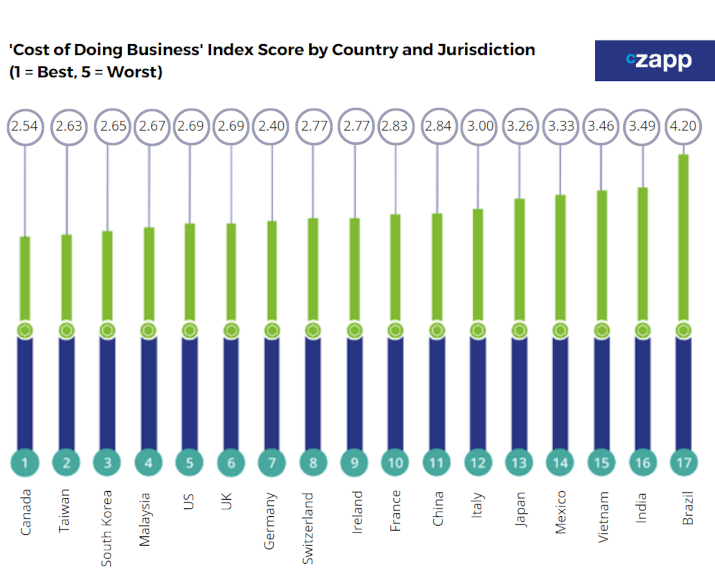

Companies are now wondering whether the cost of doing business overseas is too steep, and supply chains are being reorganized to prioritize domestic or regional production.

Source: KPMG

This has led to a rise in “slowbalization” – lack of political support for open trade – nearshoring and friendshoring. You can read more about onshoring trends here. Find out about retailer inventory challenge s here.

Food Security Power Dynamics Shifted

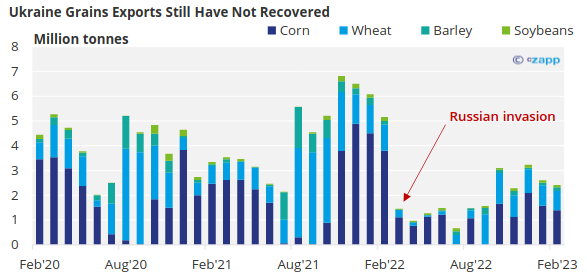

The invasion of Ukraine by Russia marked a shift in political dynamics, and given the importance of both countries to the global food system, this had a massive knock-on effect. Ukraine and Russia combined export about 13% of the world’s wheat.

Not only this, but Russia is a major fertilizer exporter.

This has had impacts on farmers in Europe, consumers in Egypt and lower income countries such as Sudan.

Source: UN Black Sea Grain Initiative, UN Comtrade

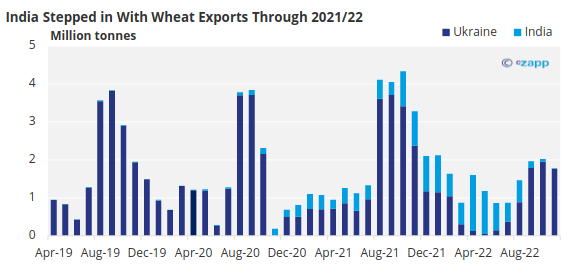

Although Ukraine’s grains imports have still not recovered, India has stepped in to fill some gaps in the export market.

Source: UN Comtrade

Find out more about fertilisers here. Information about grains from Russia and Ukraine can be found here. India’s role in global wheat exports in 2022 is explained here.

More Taxes Were Imposed

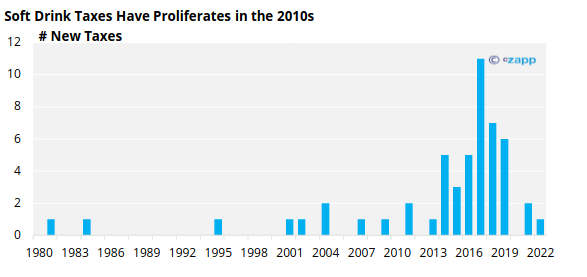

There was a much higher prevalence of sin taxes. Although the 2014-2019 period was the most active in terms of new sugar taxes imposed, more evidence emerged on the impacts.

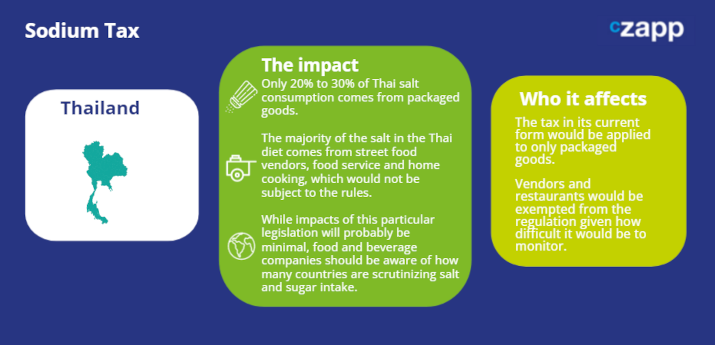

And more countries imposed other sin taxes. In Thailand, a sodium tax in on the table for packaged foods such as noodles.

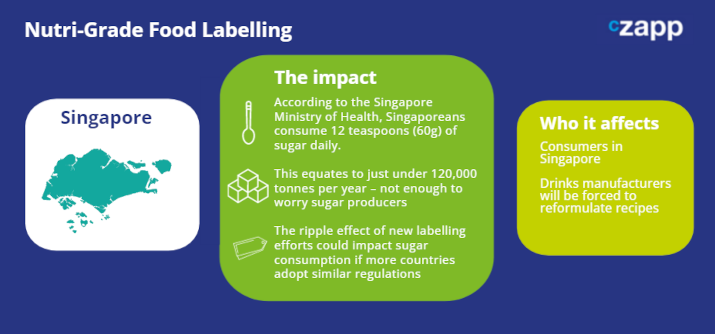

In Singapore, the government wants to roll out a new labelling scheme in an effort to incentivize reformulation.

Read more in our sugar consumption case studies here.

The WHO also called on world leaders to legislate against trans fats (TFAs), proposing a 2g limit for every 100g of total fats on all food products. Find out more about the effectiveness of sugar taxes here. You can read about new legislation on the table in 2023 here.

Alternative Protein Suffered – But Dairy Won Out

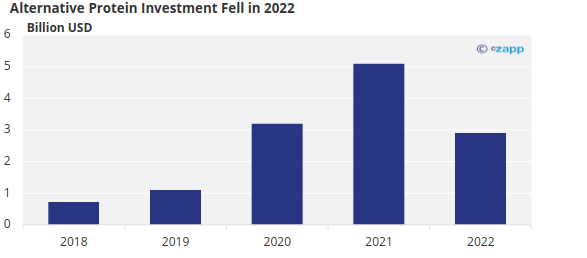

Despite early positive signs, investment in alternative proteins dropped significantly in 2022.

Source: GFI

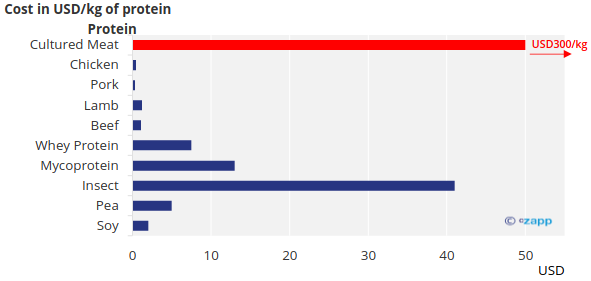

Most alternative proteins still come at a higher cost than traditional proteins. This means demand for the products are unlikely to pick up while inflation remains high.

Source: McKinsey

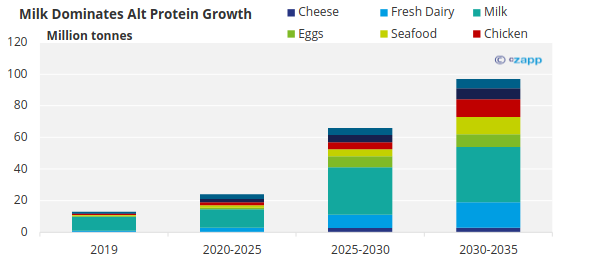

But milk seems to be the only exception to the rule. Demand for alternative milks is gaining pace quickly and makes up the fastest growing segment of alternative proteins.

Source: BCG

In the UK, about a third of consumers now drink plant-based milk, with the largest consumer segment made up of younger generations aged 25-44, according to Mintel. And in the US, Good Food Institute says that plant-based milk has a penetration within 42% of households. Read more about alternative protein demand here. Or find out about the UK dairy industry here.

Concluding Thoughts

- There were several themes that were extremely prominent in the past few years.

- One of the biggest lessons learned has been just how interconnected our food systems are.

- This can serve as both a strength and a weakness.

- Detangling of supply chain snarls will likely take several more years.

- The changing geopolitical environment and questions around food supply will continue to transform food systems.