Insight Focus

- October milk collections in New Zealand hit 254.4 million kilograms of Milksolids (kgMS).

- Fonterra lost more in North Island than expected.

- Non-Fonterra gains could continue into November.

New Zealand Milk Collections

The latest milk collection figures for the month of October have been reported by all dairy processors. Our call of around 256 million kgMS for New Zealand Milk Production in October was pretty close, with the actual DCANZ print coming in at 254.4 million kgMS.

Fonterra lost even more milk in the North Island than we had expected, while our model for the non-Fonterra group was spot on at 54 million kgMS.

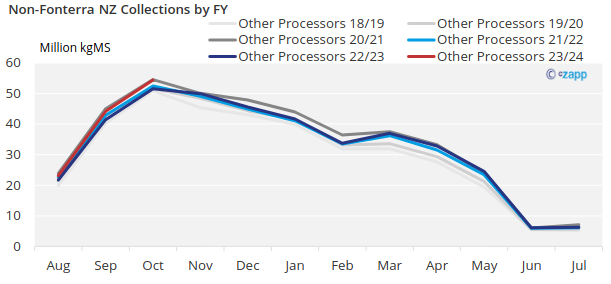

As we had expected, the volatile weather conditions in October were generally positive for milk collections. New Zealand collections are now up 0.7% Fonterra financial year to date (even though Fonterra itself is down 0.7% through the same period).

As is typical this season, all milk collection growth in October came from the non-Fonterra processors. The group are up 6.2% FYTD. With Fonterra reporting weakness in the North Island, we continue to believe that the non-Fonterra gains are being boosted by milk supply won away from Fonterra.

High Temperatures Create Drier Conditions

I was recently in Taranaki and couldn’t believe how green it was. Unfortunately, I only thought to take a photo as I was leaving and was on the wrong side of the plane.

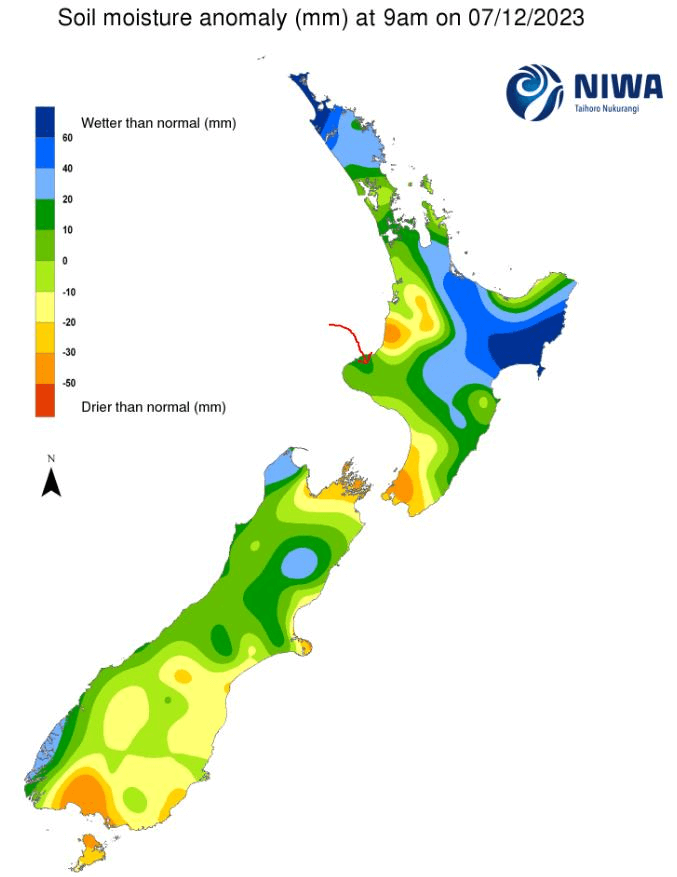

Bear in mind that this photo was taken above the point I have marked on the NIWA map below, which is in great condition.

New Zealand weather in November was consistently dry in most key dairying regions and the average temperature for the month was a steady 0.4 degrees Celsius higher than a typical November. This explains why the current soil moisture anomaly is starting to show dryer than usual patches appearing in the Western Waikato and lower South Island. We will be monitoring this closely.

We are looking for around 238 million kgMS for New Zealand milk production in November. The expectation would be approximately 187 million kgMS from Fonterra, but even this relies heavily on gains in the South. The non-Fonterra group could conceivably total 51 million kgMS or more.

Source: NIWA

New Waikato SMP/Butter Plant Planned

Competition for milk is going to heat up even more in Waikato with a new skimmed milk powder (SMP)/butter plant being planned for late 2025.

Even though the SMP/fat stream (especially SMP/butter) is extremely favoured compared with whole milk powder (WMP) in NZ at present, some processors are constrained on their fat production. This means that WMP is still in relative oversupply compared with expectations based on stream returns.

A large proportion of non-Fonterra SMP is believed to be held by traders. With less New Zealand SMP around than the market may expect, and at a substantial discount to EU substitutes, we should see this start appearing in MENA and Southeast Asia soon.

New Zealand Snaps Up Some Algerian Demand

There were a few developments in Algeria this month.

- ONIL closed about 13,000 tonnes of WMP and 12,000 tonnes of SMP in November. Non-Fonterra processors did well in allocating some of their milk gains toward winning the bulk of this.

- Sanitary Derogations (import exemptions) have not been widely issued to the private industrials for almost six months. Many are desperate for product, so we expect Algerian demand to resume strongly again soon.

- One large player is running a tender at present and interestingly New Zealand has won the lion’s share of their SMP demanded, which is unusual. This reflects the high premium of EU SMP over New Zealand at present and follows from my point on New Zealand SMP above.