- This biweekly series will focus on the dairy industry.

- It’ll discuss how it varies around the world.

- It’ll then focus on what the industry might look like in the future.

The Basics

The following pictures are fast becoming nostalgic memories and we’ll explain why.

Although milk consumption can be traced back around 7,000 years, the changes to dairy farming and associated industries have been dramatic in the last 60 years or so.

More than 80% of milk production comes from cows, with buffalo making up most of the remainder. According to the FAO, in the last three decades, world milk production (not just from cows) has increased by more than 59%, from 350m tonnes in 1998 to 843m tonnes in 2018. At the time of writing, we’re around 1 billion tonnes.

We must be cautious when predicting future growth predictions because of COVID-19, and the fact the dairy industry is struggling with global supply-chain difficulties. A very rough average of expert opinion is 2.5% CAGR (Compound Annual Growth Rate), spread unevenly across the globe.

Production/Consumption Increases and Market Segmentation

This growth has come from a range of developments, all conspiring at the same time.

1. Improved Genetics and Feeding

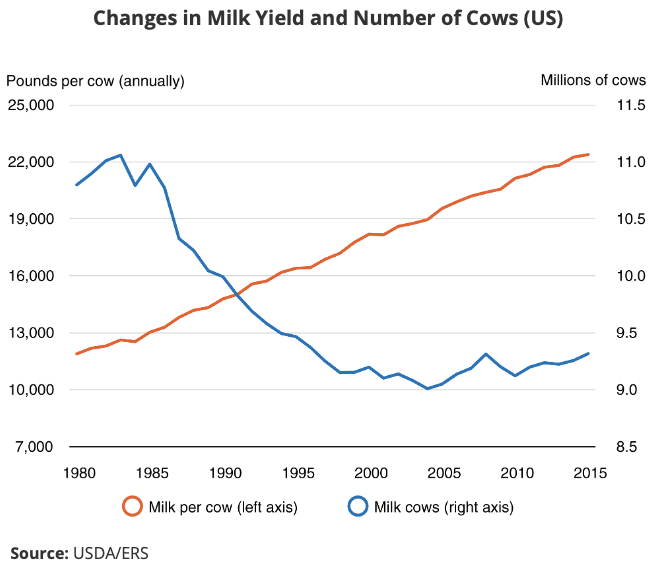

Take US production figures (which show a similar trend to many European countries) as an example.

This dramatic growth in yield per cow is a combination of many things but at the forefront are likely improved genetics, feeding regimes and medicinal regimes. There are other knock-on effects. In the last decade, in the US, dairy farm numbers have declined by over 35% (mostly small farms). Although the predominant system is year-round housed Holstein-Friesians (black and white cows), and although statistics are sparse, it’s likely that dairy pastureland has declined and can be used for other desirable purposes.

Any future increase in production rates will be greatly affected by the type of system used. As a rule of thumb, and according to the OECD, in countries using grazing-based systems, milk production increases will come from the number of herds, whereas when special feeding is used (fodder and nutrients to housed cows), increases will come from improved productivity.

2. Population Growth

This in itself may not have been the biggest driver, but when we look at increased urbanization and individual wealth, there’s a strong correlation between improved GDP per capita and milk consumption.

As we’ll be demonstrating in this series of articles, this has major implications for growth of liquid milk consumption, as the largest percentage growth will be in Asia, Africa, the Middle East, and South America. It will be almost static in the Northern Hemisphere but with stronger growth coming from a wide range of new and improved consumer offerings, some exportable to the above-mentioned regions of the world, such as Whole/Skimmed Milk Powder (WMP, SMP), infant formula, cheese, and bakery and confectionary products.

The new patterns of consumption are already starting to shift production to different geographical regions. Globally, more than 80% of liquid milk is consumed or processed within the region of origin, because of the cost of transporting a product that is mostly water.

3. Refrigeration and Transportation

Milk is a perishable product and the ability to cool it on farm, transport it by efficient road and rail networks as part of the cold chain, pasteurize it in the factory, and export it in usable forms, have improved efficiency implications with less wastage.

Transportation can occupy up to 30% of the total cost of milk production. Similarly, the use of the home refrigerators in quantity from the 1950s and the use of the cars to travel to supermarkets from the late 1960s reflect a changing pattern of consumer behaviour.

4. Increased Efficiency and Productivity

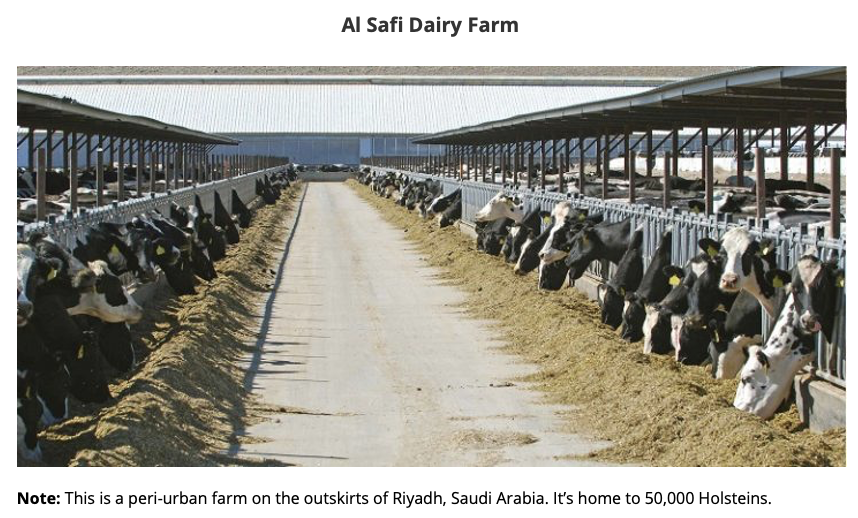

As well as economies of scale, as farms get larger, a new type of dairy, the “peri-urban” (peripheral) farm has taken root. Close to the urban centres, they rely entirely on purchased feeds and are of sufficient size to have access to the latest genotypes and selective breeding (through artificial insemination), reproductive efficiency by controlling calving intervals and conception rates, and fodder to milk conversion rates.

Dairy farms are also rapidly increasing in size in the developing world as well, moving away from “backyard” family operations.

5. Use of Technology

This has also helped with efficiency of production. Some examples include:

- Facial Recognition Technology. This allows identification of individual cows and provides alerts if an animal is behaving erratically or walking irregularly. It can also allow for the adjustment of feed for each animal to provide the optimum relative to milk output.

- Robotic Milking. The cows choose when they enter the parlour, lured by feed and the need to reduce pressure on their udders. The milking machine is laser guided onto the cows’ udders. Cows perform exceptionally well under this low-stress method, and a range of data can be collected at the same time, such as feeding pattern, health, and milk quality.

- Intelligent Collars. It’s similar technology to the monitor you wear if you go running or cycling. There are many benefits from the data downloads, but the most important is knowing when the cow is in heat and ready for (expensive) artificial insemination, increasing pregnancy rates.

Cows are fickle creatures and happy and healthy cows give more milk.

Next Time…

In the next article, we’re going to go shopping, because consumer taste is very important in this industry.

What consumers want (quantity and diversity) in Beijing, Rome or Sao Paulo is radically different. For example,

Finland consumed 457.7 kg/person/year of milk in 2017, Brazil consumed just 143.95 kg/person/year, and South Korea consumed just 18.21 kg/person/year.

There’s a lot to discuss here. It’s also worth considering what’s going to happen in the biggest growth sector in percentage terms: plant-based dairy products, like oat or almond milk.

Later, we’ll see how the supply chain responds to this.

Other Insights That May Be of Interest…

Market View: New Czapp, Same Sugar Market

Molasses and the Energy CrisisChile Struggles to Secure Sugar Amid Logistical Chaos