Insight Focus

- Urea prices rise due to limited Asian supply and emerging demand from western markets.

- While the phosphate market remains muted, potash continues to extend declines.

- The Red Sea conflict is resulting in difficulties in the ammonia supply chain.

Urea Moves Higher on Demand from US, Europe, Brazil

Urea prices are on the move to higher levels across the board. As predicted, once the giant import markets of the US and Europe started showing interest in urea, prices responded accordingly. In addition, Safrinha in Brazil is said to still need to fill 30% of demand, and price levels are now at USD 350-365/tonne CFR.

Middle East FOB levels are creeping towards and above USD 350/tonne for shipments into February and March. Egyptian prices are as high as USD 375/tonne FOB.

In Asia, China is still absent from the export market and there is no expectation that it will re-enter the markets until the domestic season is over. However, increased domestic production, low domestic demand and no exports are building inventories, so the Chinese government may be forced to advance the export date. China’s urea exports in 2023 ended at 4.25 million tonnes, up 50% from the year before.

There are limited exports across other Asian producers, with Petronas of Malaysia planning to close one factory for planned maintenance and another due to an unexpected technical issue. Indonesia’s government has blocked exports by withholding port clearance for products already under export license. The move is suspected to be related to the election to be held on February 14 as the government wants to be seen as looking after the interest of the farmers and making sure there is sufficient product available.

According to reports by Reuters the India government has indicated that future imports of urea will be reduced significantly and that the 2024-25 import volume would be around the 4-5 million tonnes level.

This is down from this year’s expected 7.5 million and last year’s 9 million tonnes and is related to increased domestic production.

If the reports are accurate, this situation would imply a readjustment of trade flows of products normally supplied to India, particularly from the Middle East, Russia and China to other markets.

China Set to Return to Processed Phosphate Market

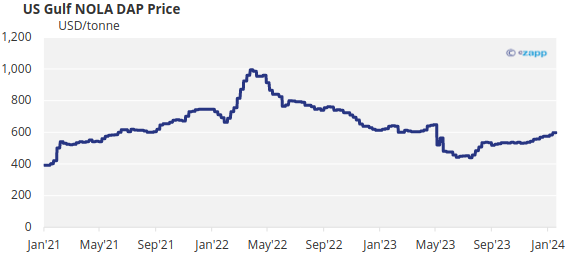

The processed phosphate market is starting to lose hope of the Indian government increasing the subsidy rates for DAP. Importers are currently losing a substantial amount of money on the import price, which is unchanged at USD 595/tonne CFR. OCP of Morocco was the only company this week to supply volumes to India at this price.

MAP prices in Brazil are coming down to closer to USD 560/tonne CFR on the back of poor returns on soybeans. Chinese exports are muted due to the government-imposed export restrictions. China is expected to return to the export market possibly by the end of February.

China’s Ministry of Industry and Information Technology (MIIT), the National Development and Reform Commission (NDRC) and another six ministries published an ‘Implementation Programme for Promoting the Efficient and High-Value Use of Phosphate Resources” on January 3.

According to the report, China will focus on strengthening the phosphorus chemical industry chain until the end of 2026. The main products of phosphate fertilizers — yellow phosphorus and other basic phosphate products — are facing overcapacity and over export, and the supply of high-quality phosphate fertilizer is insufficient.

In the past 10 years, China’s average ratio of DAP export to production is 38% and this even reached 48% in 2018. The MAP export ratio quintupled from 6% to 29% from 2013 to 2021. After the export inspections were put in place in October 2021, the 2022 export ratio of DAP and MAP decreased 37% and 45% year on year, respectively.

From January through November 2023, China’s exports of DAP and MAP were 4.67 million tonnes and 1.91 million tonnes, respectively, accounting for 36% and 16% of the total production in the past 11 months. China’s share of the MAP export market is relatively stable, while its share of DAP is increasing.

Brazil Potash Oversupply Could Benefit US

On the potash markets, Brazil, the US Midwest and Southeast Asian markets have seen a noticeable drop in MOP prices. Meanwhile, other benchmarks remain unchanged, on the back of subdued demand and oversupply.

The global market is focused on Brazil this week as the granular price range extends its decline to an average of USD 295/tonne CFR amid an oversupplied market. As the Brazilian market slumps to its lowest since the start of March 2021, suppliers may start to look to the US for higher profits. The premium on the US NOLA benchmark compared with Brazil’s benchmark is currently at an average of USD 55/tonne.

Southeast Asian standard MOP fell USD 10/tonne CFR at the low end as the region has experienced downward pressure, which some market players have suggested may be due to aggressive selling on the part of BPC.

European MOP spot prices were unchanged, amid ongoing signs of weakening in the market. Northwest European MOP remains at an average price of EUR 355/tonne CIF and granular MOP at EUR 385/tonne CIF, both for the ninth consecutive week. Prices may decline in the coming weeks because of sufficient supply and limited demand.

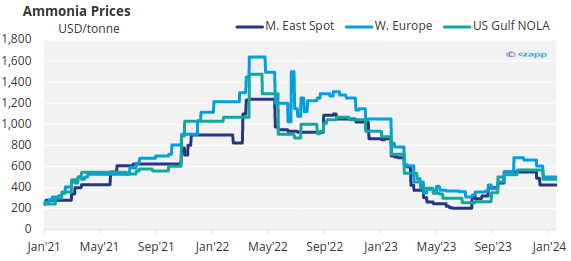

Red Sea Fragments Ammonia Market

The global ammonia market appears to be facing substantial logistics issues related to the attacks in the Red Sea with East to West supply chains creating uncertainty.

European buyers receiving volumes from the Middle East are facing considerable headaches with most participants reluctant to enter the spot market or commit to lengthy voyages until the picture becomes more settled. Price fragmentation is also apparent with a clear oversupply in the East but a tightening supply/demand balance in the West.

Current spot prices in the Middle East range between USD 390-410/tonne this week, down USD 35/tonne from last week. An export sale of Indonesian ammonia was this week made at USD 405/tonne FOB, yet a sale to China was made at USD 370/tonne CFR. A sale to India this week was reported at USD 320/tonne CFR.

In other words, ammonia pricing appeared confusing this week, although market participants indicate further softening of prices East of Suez.