Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

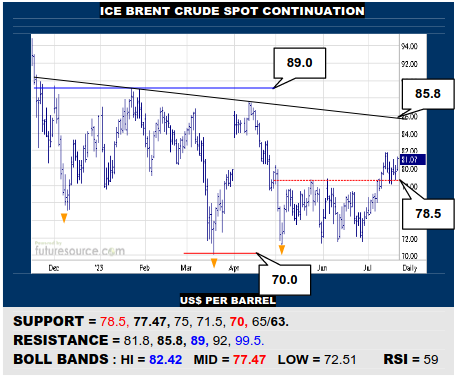

ICE BRENT CRUDE OIL SPOT

Brent preserved its getaway across the 78’s this week and so nearby action is acquiring a flaggy feel and 81.8 would duly be watched as a trigger from this pattern to reach on towards the 85.8 exit from a major inverse H&S. Only reeling back through the 78’s and the oncoming mid band (77.47) would disrupt the new Q3 applied improvements.

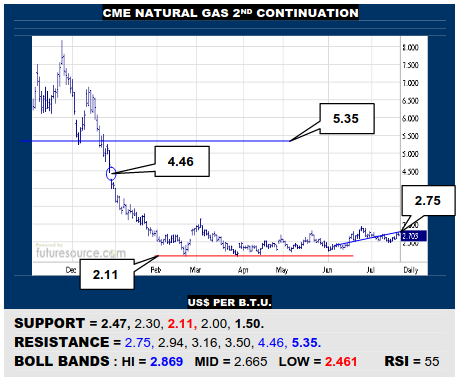

NYMEX NATURAL GAS 2ND CONTINUATION

Try, try again for Nat Gas as it attempts another foray north. This must make a decisive impression beyond the 2.75 neckline to the small late Jun H&S in order to convince of greater buying fuel reserves that might finally allow declaration of a larger saucer shaped base. If foiled in the 2.70’s though, keep eying 2.47 as the trapdoor towards 2.11.

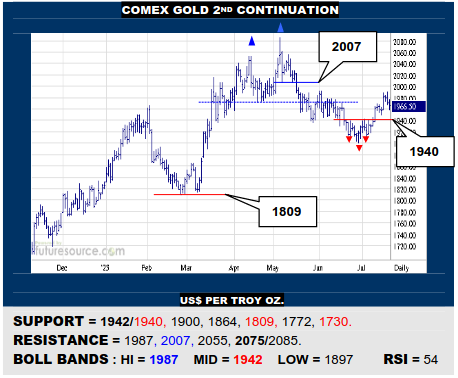

COMEX GOLD 2ND CONTINUATION

Gold managed a mid year upturn from a small inverse H&S but has cooled at its upper Bollinger (1987) this week as the Dollar fights back. Would cater for a dip towards the mid band and base (1942/1940) then but only breaking through there would douse the flame completely. Hold the 1940’s and a further leg into the 2K’s could still subsequently ensue.

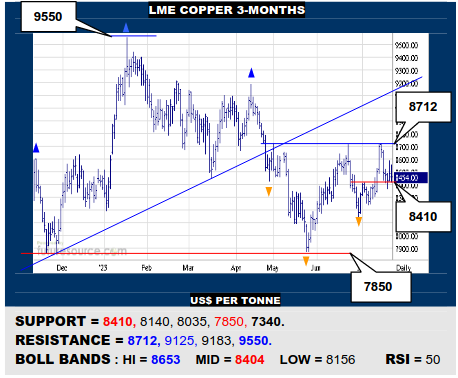

LME COPPER 3-MONTHS

Copper was blocked again by the 8712 resistance but has initially held the fort aboard the 8410 immediate support ledge that also marks the mid band. While intact, there maybe opportunity for a third run at 8712 and a pivotal breakout topside. Alas, if pressed out of the 8400’s, watch for a toppier outcome if the 8140 trough later gave way.

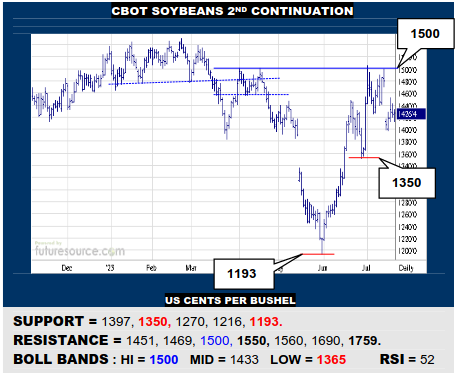

CBOT SOYBEANS 2ND CONTINUATION

A rather distorting continuation contract shift broke the mid band so Beans must close over 1451 to counteract this and hone sights on 1500 again as a broader base escape hatch onto a path up to 1759. In the meantime be wary of ouster from the 1400’s leading to an increasingly toppy pattern where breaking 1350 would signal deeper fallout to 1193.

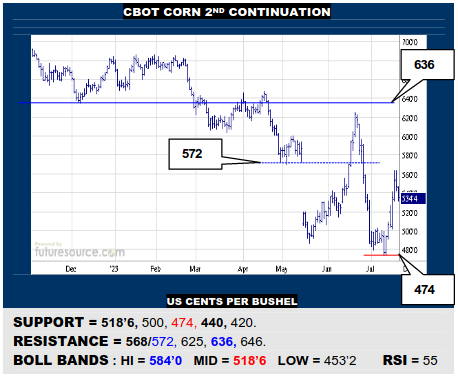

CBOT CORN 2ND CONTINUATION

A sharp rebound from the 470’s but Corn has let off the gas just shy of a 568 Fib retracement so the footing must be proven by balancing on the mid band (518’6). If so able, then look for a further flurry to try to dislodge 568/572 and make a run for the main 636 barrier. If the mid band failed to hold though, beware a deeper gouge to the 440-420 monthly support.

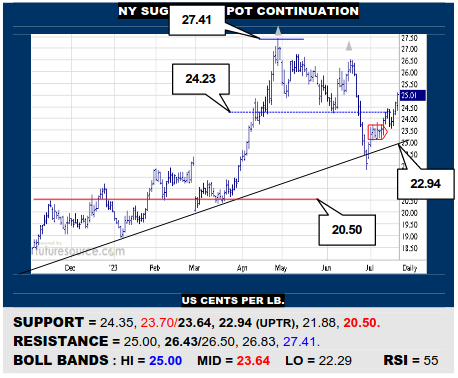

NY SUGAR #11 SPOT CONTINUATION

Propped up by the prior sub-23.70 pennant, Sugar has rallied again to thrust further into the former double top, enhancing the post-Jly contract period. Keen to see the upper Bollinger veer north now to access the 25’s, in which case paving the way to the 26.40’s. Only a 25₵ stumble and reversal through the 24.30’s would pose new danger for 23.70.

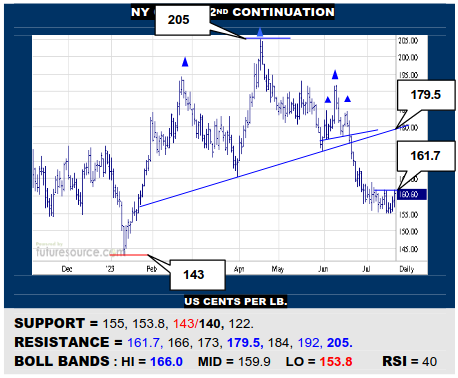

NY COFFEE 2ND CONTINUATION

Diligent defence in the 155’s has facilitated an initial mid band vault and if Coffee can hammer this home with conquest of 161.7 as well, it could claim a more persuasive turn higher to create scope up towards the H&S neckline at 179.5. Only several stumbles at 161.7 would dilute the swell and insist on still watching 155 as a tripwire on through to 140.

B-BERG / US DOLLAR RATIO

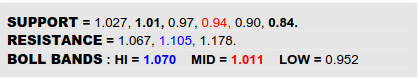

Brent completing its mid year base by popping the $78’s helped the B-Berg shed its downtrend and the same happened here on the Ratio while also phrasing ’23 into a slightly skewed inverse H&S. Encouraging events therefore that heighten suggestion of a commodity resurgence and the road to 1.105 beckons as the upper Bollinger band pushes ahead to 1.07. Nonetheless, there is still the concern associated with the Dollar swerving back up from a 99.65 ‘measuring’ gap target and so the corresponding 101.60’s gap needs watching alongside the span between 1.027 and the oncoming mid band (1.01) here, a gouge back down through it all clearly taking the wind from the wings.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.