Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

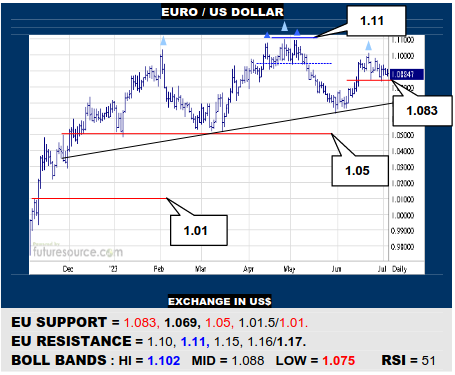

EURO / US DOLLAR

Plainly momentum has fizzled in ’23 with the EU repeatedly foiled in the 1.10/1.11 region. This implies a frail footing and slipping off the 1.083 ledge would sound a warning for atest of a mild 1.069 neckline where a large 7-month H&S could resolve and tip the balance back to the 1.02/1.01 realm. Must blow the lid at 1.11 to find renewed verve.

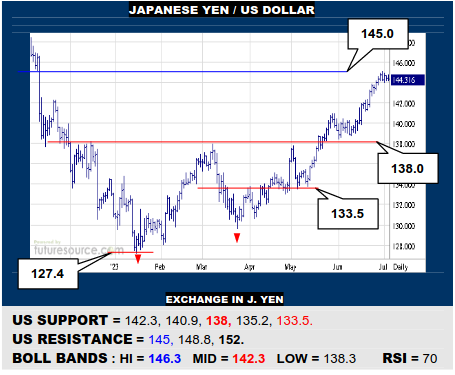

JAPANESE YEN / US DOLLAR

In the wake of building a 6-month double bottom under 138, the US has cruised on up to tag the next main hurdle at 145. Prospects for a correction duly increase so would watch the mid band (142.3). Bed in above it and a next leg over 145 towards 152 could soon be sought. Pull back below and a deeper delve towards 138 could threaten.

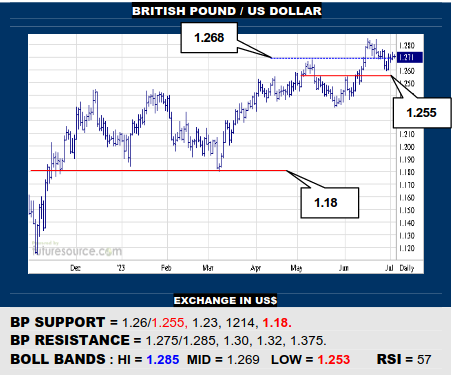

BRITISH POUND / US DOLLAR

A late Jun dip left a prior small base shape under 1.255 unscathed and so looks ostensibly corrective. That still keeps the BP in with a shot at escaping over 1.285 and rambling on into the 1.30’s. Mindful 1.275 met a Fib retracement of the previous big ‘21/’22 decline though so if 1.255 did snap, beware a sharper downturn back towards 1.18.

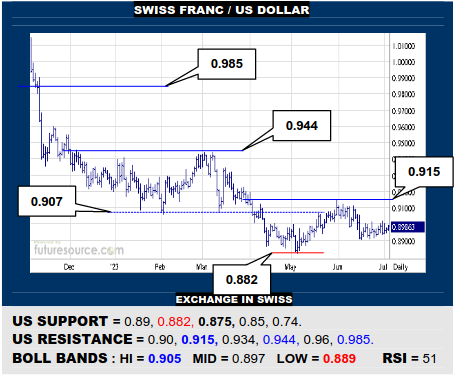

SWISS FRANC / US DOLLAR

A murky truce played out in Q2 as the US steadied but couldn’t truly round the corner. It now needs a stab back into the 0.90’s to get things percolating and to take aim at an actual 0.915 base exit where a better turn could be hailed. Not entirely secure meantime and would fear heavy fallout if the early ’21 trough at 0.875 was breached.

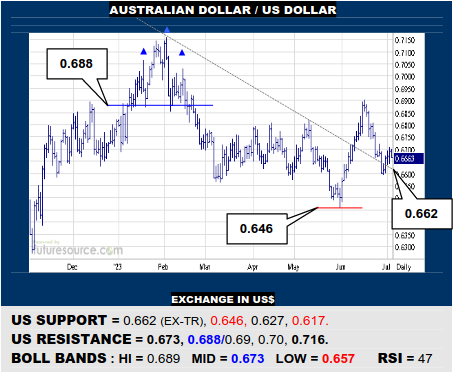

AUSTRALIAN DOLLAR / US DOLLAR

The AD has managed to restrain its setback in the vicinity of the ex-downtrend (0.662) but must react back over the mid band (0.673) to reassure this ‘catch’ and thus have a fresh shot at trying to pry open the Q1 H&S above 0.688. However, slipping from the 0.66’s would instead resume lower and could well break 0.646 to press to 0.617.

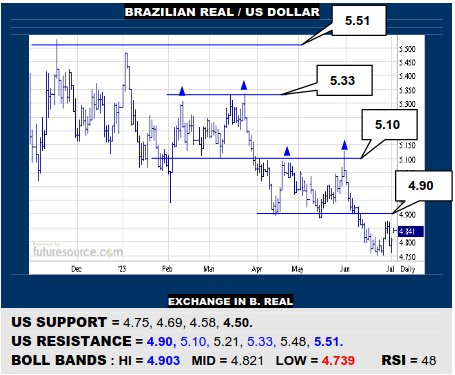

BRAZILIAN REAL / US DOLLAR

The US mustered a late Jun bounce but hasn’t been able to trouble the 4.90 Q2 double top rim. It must punch through there to make more of an impact that could then open passage towards 5.10. By no means a secure footing meanwhile and breaking 4.75 would warn of reaching on south towards the major monthly uptrend at 4,.50.

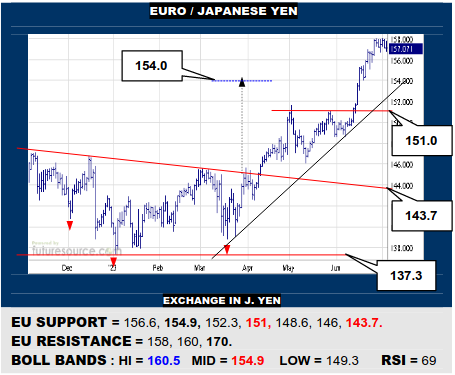

EURO / JAPANESE YEN

The EU has easily outreached the 154 inverse H&S projection and there just isn’t much in the way up here until the ’08 Everest at 170. However, a little wheelspin at 158 suggests a corrective risk so, if 156.6 gave way, cater for a mid band test (154.9), though only a break of that too would raise concern of a deeper delve back to 151.

EURO / BRITISH POUND

A corrective bounce late in Q2 after falling from a Q1 H&S is already unraveling and the 0.852 trough needs watching as a sort of bear flag trigger that would point on down towards a longer term low at 0.82 where a massive 7-year top could be resolved. The EU must hold 0.852 and deny the flag to have any chance back up to 0.872.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.